Associated Scholars

Fernando Alvarez

John H. Cochrane

Douglas W. Diamond

Wenxin Du

Lars Peter Hansen

John C. Heaton

Anil Kashyap

Timothy J. Kehoe

Ralph Koijen

Yueran Ma

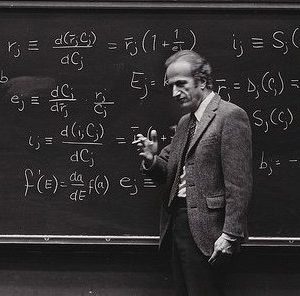

Thomas J. Sargent

Amir Sufi

Harald Uhlig

Associated Research

Implications of Fiscal-Monetary Interaction from HANK Models

Limited Risk Transfer Between Investors: A New Benchmark for Macro-Finance Models

Associated Past Events

Frontier Topics in Macro-Finance

Associated Upcoming Events

Call for Papers: 2025 Macro Finance Society Workshop

Associated Insights

Associated News

Macro Finance Research Program (MFR) 2024 Summer Session for Young Scholars

Paying Up to Save the Amazon May Be Cheaper than the Alternative

Macro Finance Research Program (MFR) 2022 Summer Session for Young Scholars

Other Initiatives & Centers at BFI

Research Initiatives

- Public Economics Initiative

- Socioeconomic Inequalities Initiative

- Political Economics Initiative

- Industrial Organization Initiative

- Macroeconomic Research Initiative

- Chicago Experiments Initiative

- Ronzetti Initiative for the Study of Labor Markets

- Price Theory Initiative

- International Economics and Economic Geography Initiative

- Health Economics Initiative

- Big Data Initiative