A famous adage says that an army marches on its stomach. Armies need money, and access to debt financing has often proved crucial to military success. For example, during the Napoleonic Wars of the early 19th century, Great Britain’s credibility with international lenders allowed for significant debt financing and delivered a military advantage over France, which relied heavily on taxation.1 This advantage in debt financing was a key factor in Great Britain’s victory, which also established Great Britain as the militarily dominant state (or hegemon: In global relations, a hegemon is a dominant power, often defined by military strength, but also including economics and other factors. ) on the world stage and financial center of the world.

Today, the title of global hegemon goes to the United States and accords similar benefits to those of the British 200 years ago, including the ability to incur debt financing in international markets at preferential interest rates. Known as an “exorbitant privilege,” this borrowing capacity puts the United States at a distinct advantage over such rivals as, say, China, a country with global aspirations of its own. China’s recent rise, both economically and militarily, is moving the country into the position of a geopolitical rival to US dominance. More broadly, the unipolar world of the post-Cold War era with the US at its center, appears to be giving way to new military conflicts worldwide. These challenges to US military dominance raise important questions about government financing in a world with globalized debt markets, including: How does the presence of global debt markets impact the military balance between countries? How does the military balance affect global debt markets? And how do hegemonic transitions take place?

The authors of this new work address these questions by, first, documenting facts about the financial privileges extended to hegemonic states, including:

- Global hegemons have historically borrowed at lower interest rates than other countries.

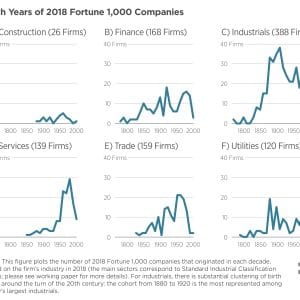

- The interest spread for different countries relative to the global hegemon rises when geopolitical tensions increase. (See figure.)

- And finally, the losers in a geopolitical conflict experience greater inflation and debt devaluation relative to victorious countries.

The authors incorporate these facts in a game-theoretic model in which military dominance is driven by internal (or endogenous: In economics, an endogenous variable is a variable in a model that is determined by its relationship with other variables in the model. Endogenous variables are also known as dependent variables. ) factors like military spending and external (or exogenous: Exogenous variables are the opposite of exogenous variables, which are independent variables that are determined outside of the model and cannot be predicted by the model. ) factors like geography and technology. Countries decide how much to spend on defense versus other goods, how much to borrow in international financial markets, and whether to default in the face of military defeat. The default rate is then reflected in a country’s financing costs, with the country expected to be more likely to suffer in a military contest facing higher borrowing rates. The model reveals the following:

- When war ensues between two countries with low debt capacity, the stronger of the two (as determined by exogenous factors) is expected to win and, therefore, experiences lower funding costs. The opposite occurs for the weaker country, which is perceived to have a higher default risk and, thus, experiences increased funding costs. Over time, the funding advantage of the stronger country increases, translating into greater relative military spending and a larger probability of victory.

- Things become more complicated when the debt capacity of the two countries is intermediate or high, including, for example, a scenario where the weaker country obtains funding to secure military victory. In this case, bond market participants anticipate that the exogenously weaker country will invest enough in the military to overwhelm the stronger country’s military advantage. The bond market’s belief underpins a lower funding cost for the weaker country, meaning that it is less likely to default, which in turn increases the country’s debt capacity in support of more military investment.

- The model also offers insights into how transitions from one hegemon to another can occur over time. Debt capacity is again found to play an important role. When debt capacity is low or intermediate, the steady state persists, whereby the initial relative level of military power determines long-term dominance (or geopolitical hysteresis: In global politics, hysteresis can mean that a country retains its dominant position even after the factors that led to that event have been removed or otherwise run their course. Similarly, in economics, the state of an economy can persist after foundational factors have expired. ). Thus, for a new hegemon to emerge, war is necessary. However, if debt capacity is high, shifts in market expectations could favor one country over the other and determine hegemony without war (a situation of geopolitical fragility). These shifts can potentially occur repeatedly, leading to volatility in both financial markets and military power.

Does a strong hegemon ensure stability? Not necessarily. Factors that strengthen the link between geopolitical and financial dominance—such as higher debt capacity, a higher probability of war, and a higher war risk premium—also bring risks, making it possible that changing perceptions in bond markets lead to coordination on a new hegemon, and leading to repeated transitions between hegemons even in the absence of war.

This analysis not only provides insight into historical conflicts but, importantly, sheds light on current relations between the United States and China. For example, any effort to boost China’s financial capacity (such as internationalizing its currency) would likely affect US national security. Similarly, any US policy that threatens its own debt capacity or status in international financial markets—such as a failure to raise the debt ceiling, resulting in a technical default on Treasury bonds—could have significant national security implications. The link between funding capacity and potential global conflict is as real today as it was 200 years ago.

1 Bordo, Michael D., and Eugene N. White. 1991. “A Tale of Two Currencies: British and French Finance during the Napoleonic Wars.” The Journal of Economic History, 51(2): 303–316.