The automobile industry is undergoing a pivotal transformation driven by global efforts to combat climate change. Many countries have set ambitious electric vehicle (EV) adoption goals, with Norway targeting 100% EV sales by 2025, the Netherlands by 2030, and the United States and China aiming for 50% and 40% by 2030, respectively. In pursuit of these targets, governments worldwide have enacted a range of industrial policies: Government measures aimed at stimulating economic growth and development within specific sectors or industries by providing targeted support, such as subsidies, tax incentives, or regulatory adjustments. (IPs), such as purchase subsidies, to promote the growth of the EV and EV battery industries.

Despite the rapid expansion of the EV sector and widespread policy initiatives across the world, there is limited understanding of how these policies affect innovation within the global automobile industry. In this paper, the authors investigate how industrial policies, specifically those aimed at promoting electric vehicles, affect innovation in the automobile sector.

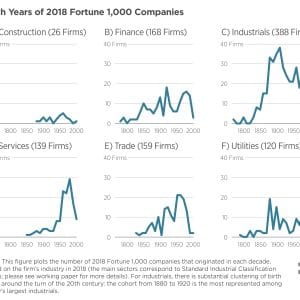

To study this issue, the authors construct a unique database of global IPs and patents for the automobile industry. They rely on over 60,000 policy documents from 2008 to 2023, which they classify as financial (e.g., consumer subsidies or tax incentives) or non-financial (e.g., production quotas or emissions standards) and as targeting either EVs, gasoline vehicles (GVs), or both. To assess innovation, the authors use patent data from 1980 through 2023, and categorize patents by type—EV, GV, or general technology. Using econometric models at both the country and firm levels, they measure how changes in policy affect EV innovation across countries and among major automakers and battery suppliers. They find the following:

- IPs targeting EVs have surged from almost non-existent in 2008 to 50% of IPs by 2022. Correspondingly, EV-specific inventions have rapidly increased, surpassing GV inventions by 2020. This parallel growth indicates a potential link between the rise of EV IPs and the shift toward electrification.

- There is a positive relationship between policy support and innovation activity. At the country level, a one- standard deviation: A measure of how spread-out values are in a dataset, representing the average distance of each point from the mean. In a normal distribution, about 68% of data points lie within one standard deviation of the mean. increase in five-year cumulative EV-targeted IPs is associated with a 4% rise in new EV patent applications. Similarly, at the firm level, where about three-quarters of all EV patents are held by the top three automakers and battery suppliers, a 10% increase in EV financial incentives received by automakers and EV battery producers leads to a similar 4% increase in EV innovations.

- The authors find that a firm’s existing expertise, or “knowledge stock,” in a specific technology—such as electric vehicles (EVs)—plays a crucial role in shaping its future innovation. Firms with a strong base in EV-related knowledge are more likely to innovate rapidly within EV technologies, while existing expertise in GVs may impede EV-related innovation. This suggests that firms already focused on EVs will see compounding benefits from policy support, reinforcing the value of sustained, EV-targeted policies over time.

- There is no evidence that EV IPs affect innovation for GV technologies, highlighting that the effects of IPs are technology specific.

This research suggests the promise of targeted industrial policies in promoting green innovation, especially in the automotive sector’s shift to EVs. By showing that specific, well-designed subsidies and incentives accelerate EV-related technological development, the authors provide crucial insights for policymakers looking to drive sustainable, sector-specific innovation while avoiding unintended spillovers into non-targeted areas.