Is it worth living in a major labor market, where wages are higher, but so is rent? For much of the 20th century, the answer was yes. Higher wages generally offset the higher cost of living. Today, however, it depends: For high-earning college graduates, the wage premium often justifies the expense, while for low-income workers without a college degree, skyrocketing housing prices wash out the gains. This divergence carries profound implications for our economy, culture, and politics, and in this paper, the authors document these trends and model the forces that may underlie them.

Regional Income Convergence

Between 1880 and 1980, workers consistently moved from low-income states to high-income states, a pattern the authors refer to as directed migration: as described above, this is the authors’ term to describe the relationship between population growth and income per capita across states. Labor is “directed” to move to regions of relatively higher income per capita, thus increasing income convergence. . This movement of labor may have contributed to regional income convergence: regional income convergence, also known as the “catch-up effect,” refers to the economic theory that poorer regions tend to grow faster than richer ones, eventually leading to a narrowing of the income gap by balancing labor supply and human capital between low- and high-wage areas. Over this same period, the authors document that incomes across states converged at an annual rate of 1.8%.

Over the past thirty years, both regional income convergence and directed migration have slowed dramatically. From 1990 to 2010, the convergence rate fell to less than half the historical average, and in the years leading up to the Great Recession, it nearly disappeared altogether. At the same time, the steady movement from low-income to high-income states weakened.

Divergence by Education

The slowdown in convergence has not affected all workers equally. Using census data, the authors show that migration patterns have diverged by education level. In the mid-20th century, workers with and without college degrees tended to move from low-income to high-income states. Today, that pattern holds primarily for workers with degrees. Those without, by contrast, are now more likely to move away from high-income places.

As a result, net migration flows no longer redistribute human capital across regions as they once did. This phenomenon, which the authors term skill sorting, marks a sharp departure from historical trends and may help explain the weakening of regional income convergence. Instead of low- and high-wage workers flocking to the same thriving labor markets, there are now places that attract college-educated workers, and others that retain or receive primarily workers without degrees.

Housing Costs and Supply Constraints

What explains this shift in migration patterns? The authors point to the rising cost of housing in high-income areas, particularly for low-income workers, as a key part of the story. For much of the 20th century, the returns to moving to a high-income place were similar for workers of all income levels, even after accounting for differences in housing costs. But over the past several decades, those returns have diverged. As housing prices in productive regions have soared, they have absorbed a much larger share of income for low-income workers, effectively erasing the economic benefits of moving. In contrast, highly educated workers still see large net gains from living in those same places.

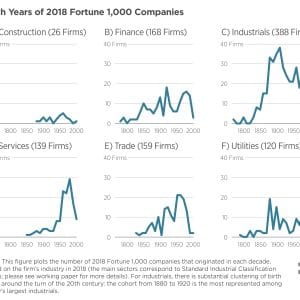

The authors argue that this divergence in returns is linked to changes in housing supply due to the growing role of land use regulations, such as zoning restrictions and permitting limits, which constrain the construction of new housing in high-income areas. They develop a novel panel measure of land use regulation based on the frequency of state court cases mentioning land use. The authors find that housing supply has become significantly less responsive in areas with higher regulatory intensity, leading to higher housing costs, reduced in-migration, and slower income convergence.