With higher education costs consistently outpacing inflation and with public funding declining, college affordability has become a critical barrier to economic mobility for middle- and low-income families. While College Savings Accounts (CSAs), or 529 plans, offer tax-advantaged vehicles for college savings, their adoption patterns and educational impacts remain poorly understood.

In this paper, the authors conduct the first large-scale analysis of College Savings Account participation and effectiveness using comprehensive administrative data. They draw on administrative data from over 900,000 Illinois 529 accounts (2000–2023) linked to educational outcomes, plus complementary surveys of account owners and parents. Their research reveals the following patterns:

- CSA participation remains concentrated among higher-income, more educated families although adoption has expanded to every ZIP code in Illinois.

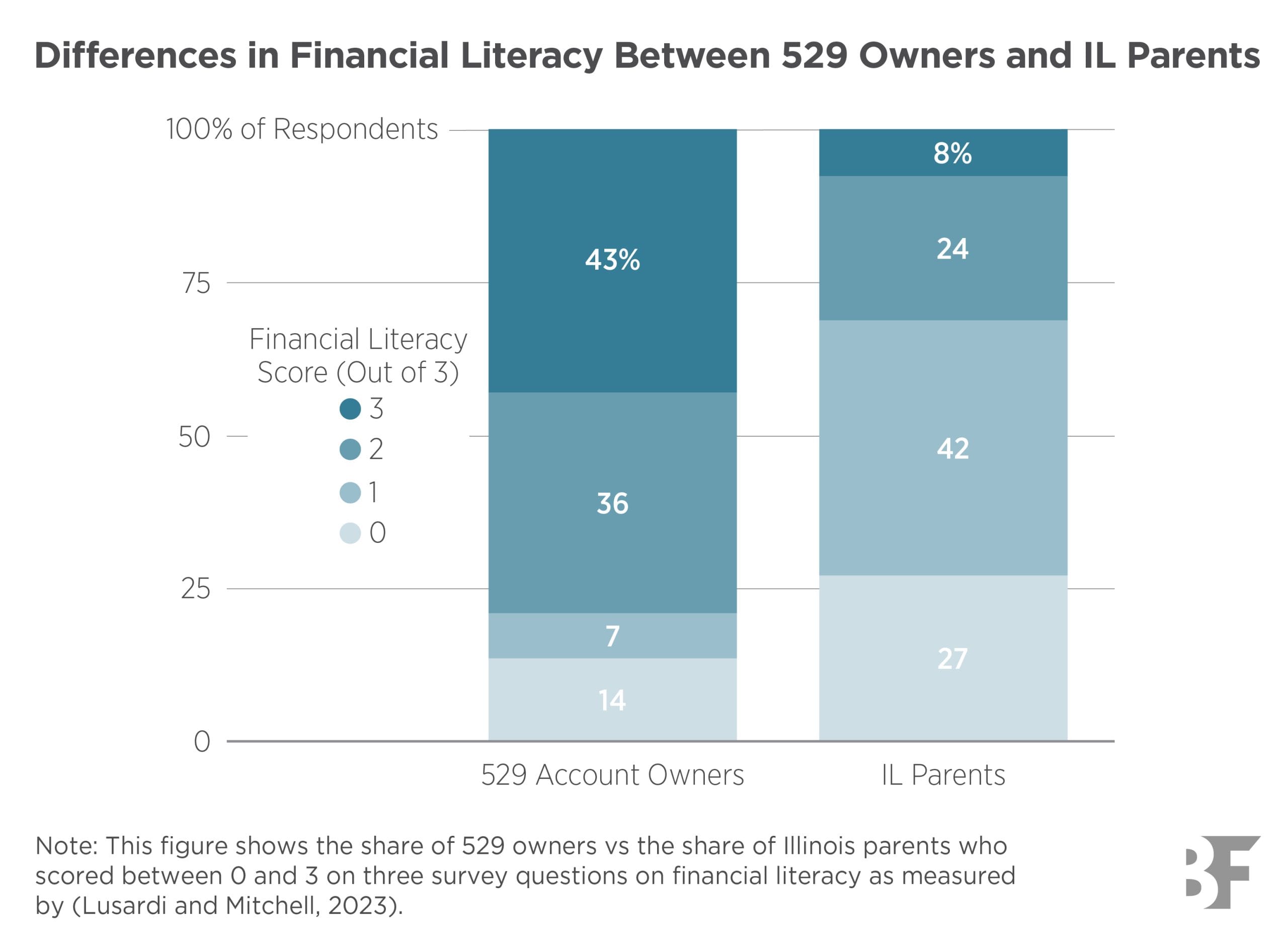

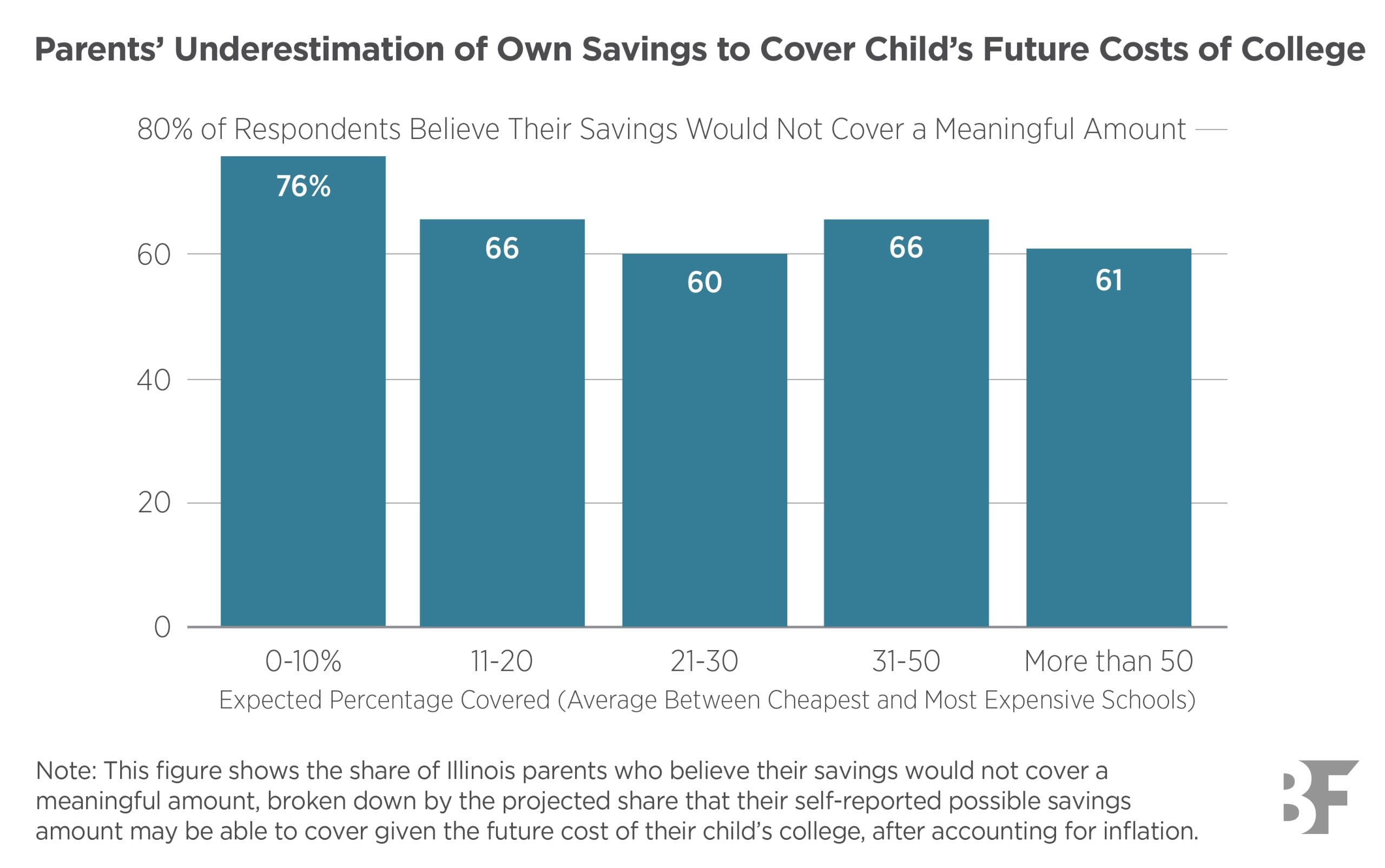

- Financial literacy emerges as a key barrier: 61% of parents who could save enough to cover half of future college costs still perceive their potential savings as meaningless.

- Among participants, higher savings are strongly correlated with better educational outcomes, including four-year college enrollment, attendance at selective institutions, and pursuit of post-graduate degrees.

These findings suggest that targeted interventions addressing financial literacy gaps and misperceptions about modest savings could significantly expand CSA effectiveness as a tool for educational equity. Beyond state-level 529 program optimization, the findings also suggest promising avenues for federal policy coordination and institutional innovation.