Between April 2021 and May 2023, the cumulative price level in the United States rose by over 14%. This inflationary period was characterized by low unemployment and historically high job vacancies. Policymakers and economists attributed these trends to a “hot” labor market, where demand for workers outpaced supply. At the same time, however, real wages: the amount of money a person receives for their work after adjusting for inflation. fell sharply, challenging this notion. In this paper, the authors offer a new explanation: They argue that inflation, not labor market strength, drove these dynamics, simultaneously increasing vacancies while pushing down real wages.

The authors construct a model to examine how inflation affects workers and labor markets. By reducing real wages, inflation prompts workers to renegotiate pay, search for better jobs, or quit, driving job-to-job transitions and increased vacancies while keeping unemployment largely unchanged. Using this framework, the authors explore the consequences of inflation for labor market outcomes and worker welfare, finding the following:

- The temporary inflation during 2021-2023 significantly reduced worker welfare across all income levels, with higher-wage workers experiencing the largest losses. The welfare losses equated to approximately 75% of monthly real income for workers in the bottom decile, 85% for the median, and 110% for those in the top decile.

- Firms gained from inflation due to increased market power, as reflected in the historically high corporate profit-to-GDP ratios during 2021-2023.

- While most of the welfare losses stemmed from real wage declines, workers incurred additional costs searching for jobs and renegotiating wages. However, these losses were nearly offset by the gains from reduced layoffs.

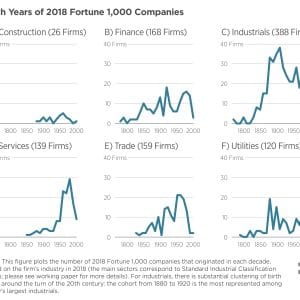

Building on these results, the authors validate their model using historical labor market data from 1950-2019. They also examine other high-inflation contexts, and find the following:

- Historical periods of high US inflation (e.g., early 1950s, mid-1970s, and late 1970s) consistently show increases in vacancy rates and vacancy-to-unemployment ratios, even when unemployment remained stable or high.

- Inflationary periods caused upward shifts in the Beveridge Curve: a graphical representation of the relationship between unemployment and the job vacancy rate, the number of unfilled jobs expressed as a proportion of the labor force. It typically has vacancies on the vertical axis and unemployment on the horizontal and slopes downward, as a higher rate of unemployment normally occurs with a lower rate of vacancies. , meaning there were more job openings relative to the number of unemployed workers. This pattern was also observed during the current inflationary episode.

- International evidence, such as Argentina’s inflation surge in the early 2000s, reveals similar increases in vacancies and labor market tightness during inflation.

The authors conclude by distinguishing between their model’s predictions and alternate “hot labor markets” theories. They show that alternative explanations for high labor market tightness, such as productivity gains, do not align with the observed declines in real wages or the specific patterns of labor market flows that were observed during the recent inflation period.

This research challenges traditional interpretations of labor market tightness during inflationary periods, demonstrating that inflation can create the illusion of an overheated labor market while eroding real wages and worker welfare. The findings are consistent with recent supply chain disruptions, energy price increases, and pandemic-related demand pressures that drove up prices without significantly increasing labor demand. Policymakers should exercise caution in interpreting high labor market tightness as a sign of economic strength and consider policies that mitigate the welfare losses caused by inflation, particularly the erosion of real wages and the costs of job transitions.