Prior to the Great Recession of 2007-08, a US middle market: Middle market firms in the United States, with annual revenues between $10 million and $1 billion, comprise about 200,000 firms. These privately held or closely owned companies contribute over $10 trillion in annual revenues and support approximately 48 million jobs. Middle market banking is geared toward middle market firms, often those that are actively growing larger and more profitable. These firms require access to more substantial working capital, customized lending solutions, cash management services, and industry-specific solutions. firm (annual revenues between $10 million and $1 billion) had little choice but to approach a bank or financial company for services ranging from capital fundraising to mergers and acquisition guidance, and other banking services. Alternative financial companies, known as direct lenders: Non-bank entities, such as private equity firms and asset managers, which provide loans to middle market firms. Direct lending, then, is a private debt strategy wherein firms bypass traditional intermediaries like banks. , were small players, accounting for less than $200 billion in managed assets. This conformed with conventional research arguing that traditional, deposit-financed banks had a comparative advantage in information and monitoring technologies, liquidity provision, and loan sourcing. Banks knew their customers, in other words, and that relationship mattered.

However, by 2024, that conventional wisdom was upended. Assets under management by direct lenders had increased sharply to over $1.6 trillion, raising questions about whether and how they substitute for banks or serve distinct market segments. What types of firms borrow from direct lenders versus traditional lenders? Are direct lenders genuine substitutes for banks and finance companies? And are there meaningful differences in lending technology and practices between these intermediary types? Understanding these distinctions is important for assessing competition, information advantages, liquidity provision, and monitoring capabilities in financial intermediation.

The authors address these questions by first constructing a novel dataset that combines multiple sources, including all US business establishments, their investments, private credit data, and private equity sponsor information. These data enable measurement of the overall penetration of direct lending across the economy, providing crucial context about which firms do and do not access direct lender financing, something impossible with existing data sources. These data reveal the following:

- Despite its recent growth, direct lending remains relatively small compared to traditional bank and finance company lending. As of 2022, only 2.5% of U.S. middle market non-financial companies borrow from direct lenders, while banks and finance companies serve 41.3% and 19.9% of these firms respectively.

- Middle market firms borrowing from direct lenders possess distinctly different characteristics compared to those financed by banks and finance companies.

- Direct lender borrowers tend to be younger firms, more concentrated in intangible capital-intensive sectors such as business services and software, more likely located in major U.S. cities, and larger in terms of total employment.

- Of direct lender borrowers, 20% operate in the Professional, Scientific, and Technical Services industry (as categorized by NAICS: The North American Industry Classification System (NAICS) is the standard used by Federal statistical agencies to classify business establishments to collect, analyze, and publish statistical data related to the US business economy. ) compared to just 5-12% of bank and finance company borrowers.

- Geographic concentration also differs markedly, with 29% of bank and finance company borrowers located in the top ten largest US cities by population, compared to 40% of direct lender borrowers.

The authors employ a measurement technique that captures differences in portfolios based on key borrower characteristics. This approach reveals substantial distinctions across intermediary types, including:

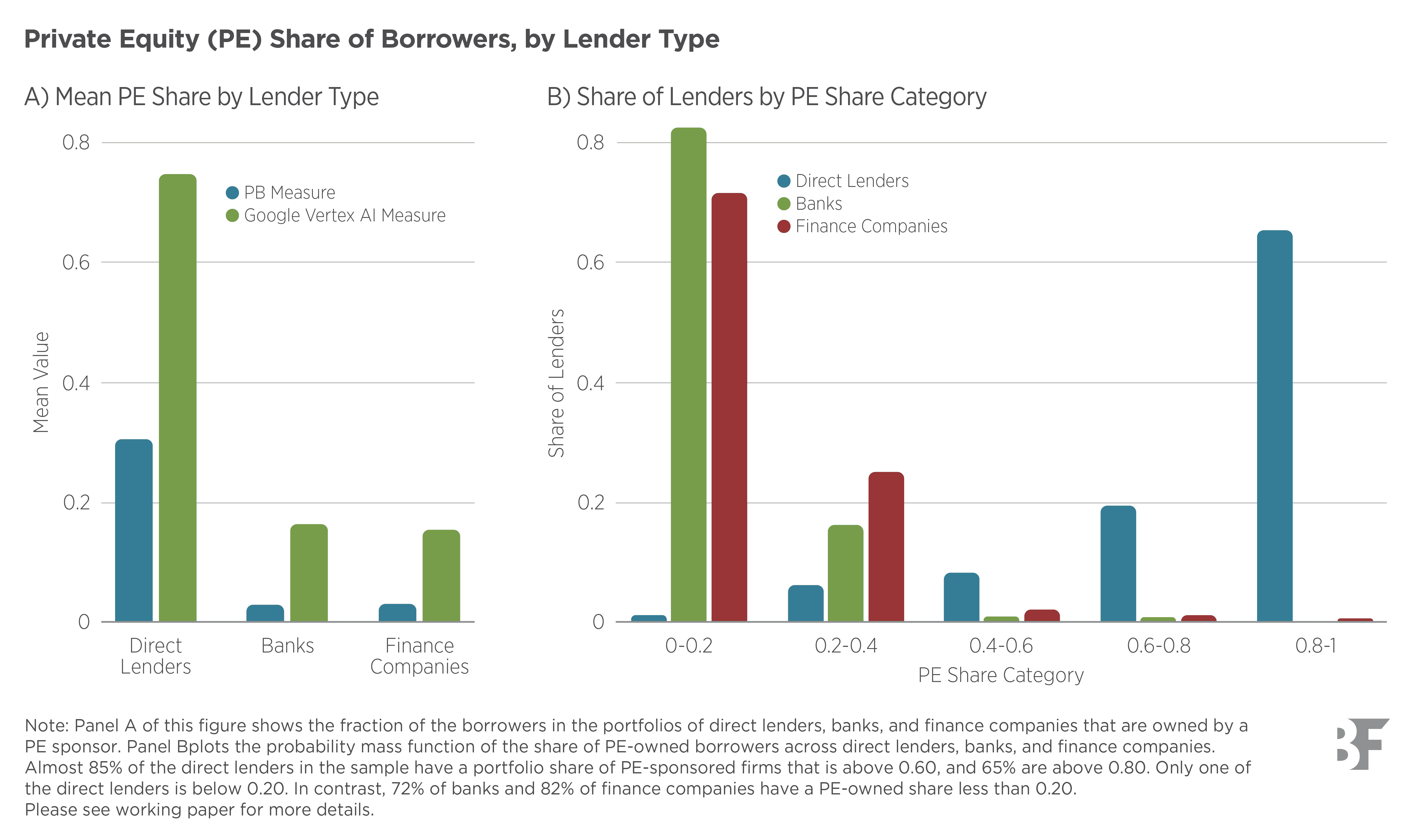

- Direct lenders focus on firms owned by private equity: Private equity is capital invested in a company that is not publicly traded on a stock exchange. Private equity firms pool money from investors, such as pension funds and wealthy individuals, to buy stakes in private companies. (PE) sponsors; namely, PE-owned firms comprise 75% of the borrowers of direct lenders compared to 17% for banks and 16% for finance companies.

- Direct lenders serve younger firms, and their markets are concentrated in urban areas and within intangible-intensive sectors.

- However, deeper empirical analysis suggests that the large differences in portfolio borrower characteristics are due to direct lenders’ heavy focus on PE-owned firms, rather than other fundamental distinctions in their lending practices.

This work reveals that direct lending activity is primarily concentrated among firms in specific industries and specific geographies where private equity investment is prevalent. Large parts of the US economy remain essentially untouched by direct lending activity, as these lenders follow private equity investment patterns that are themselves geographically and industrially concentrated, leaving significant segments of the middle market outside the scope of this growing but still specialized financing channel.

However, as direct lending expands, questions arise about whether its close ties to private equity will persist. Recent trends show PE transactions have slowed amid rising pressure on direct lenders to invest in alternative asset classes, such as broadly syndicated loans and asset-based financing. In addition, providing broader debt financing to much larger firms, or lending against specific collateral, implies a different risk-return profile, which could present a challenge. Finally, this raises a broader question left for future research: Is direct lending more a relationship-based business or can it be transformed into a more arm’s length debt market?