As Ukraine emerges from the devastation of war, it faces a historic opportunity to engineer its own Wirtschaftswunder—a productivity-driven economic transformation akin to post-war West Germany. While investment-led growth may offer quick wins, the country’s long-term trajectory will depend on whether it can foster the forces of creative destruction: the process of innovation and technological change where new products, processes, or business models replace older ones, leading to the dismantling of established industries and ways of life that drive sustained economic progress. Understanding what has held back Ukraine’s economy over the past quarter-century provides crucial insights for designing effective reconstruction policies.

To identify what has constrained Ukraine’s economic dynamism, the authors analyze comprehensive firm-level data spanning nearly the entire universe of Ukrainian enterprises from 2002-2024. They combine financial statements data with detailed information on foreign direct investment flows and the complete registry of state-owned enterprises, enabling unprecedented insight into both private and public sector dynamics.

The empirical analysis reveals troubling patterns of declining business dynamism:

- Ukrainian firms shifted from “up or out” to “flat and stay” dynamics. In 2002-2007, new firms exhibited vigorous growth patterns mirroring the United States, with surviving firms expanding rapidly. Between 2008-2013, business dynamics flat lined, resembling stagnation seen in Mexico. After 2014, the forces of creative destruction appear to have been choked, with young firms barely increasing in size over a decade—a pattern strikingly similar to India’s chronically sluggish business lifecycle.

- Market concentration rose dramatically while productivity stagnated. The four largest businesses in manufacturing sectors increased their market share from 49% in early 2000s to 53% in 2019. This occurred alongside declining productivity growth, from 15.2% annually in 2002-2013 to just 3.7% in 2014-2019.

- State-owned enterprises hold a large share of sales, effectively crowding out private enterprise. Though overrepresented among laggard firms, their share in top productivity quintiles substantially declined over time.

- Foreign investment from tax havens stifles competition. Industries receiving investment from offshore financial centers exhibit 27% lower entry rates, suggesting that recycled domestic capital undermines business dynamism rather than bringing new technology and expertise.

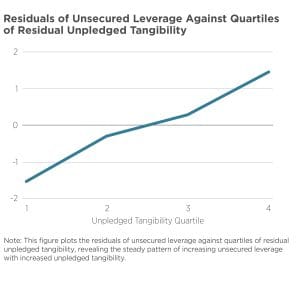

The data reveal a troubling pattern: productive firms struggle to grow while unproductive incumbents not only survive but expand their market share. To explain this reversal of competitive dynamics, the authors develop a theoretical framework embedding institutional capture into a Schumpeterian model of creative destruction.

The authors build a quantitative model and estimate its parameters using key patterns in Ukrainian firm data from 2002-2013. The model’s core mechanism centers on “entrenched” incumbents who gain market control through regulatory capture rather than productivity improvements, competing against innovative “transformative” entrepreneurs. The structural estimation reveals that transformative firms risk losing a product line to entrenched incumbents through institutional — rather than technological — displacement roughly every 10 months, creating strong disincentives for innovation and growth. The quantitative results strongly validate the entrenchment mechanism:

- The model shows that institutional capture breaks down resource allocation. Higher entrenchment reduces the correlation between firm productivity and size, explaining the observed deterioration in how efficiently productive firms can expand and attract resources.

- Entrenchment flattens firm life-cycle profiles and increases persistence of small firms. The model replicates Ukraine’s transition from dynamic “up or out” patterns to stagnant “flat and stay” equilibrium as institutional capture rises.

- Policy effectiveness depends critically on institutional quality. R&D subsidies for incumbents can boost growth when entrenchment is low, but become progressively less effective as institutional capture rises. Entry subsidies show minimal impact regardless of institutional environment due to general equilibrium crowding-out effects.

The analysis yields a crucial insight for Ukraine’s post-war reconstruction: targeting firm types alone is insufficient. Even perfectly designed subsidies will have limited aggregate impact unless accompanied by reforms that discipline entrenched incumbents and restore competitive market dynamics. This mirrors the priorities of West Germany’s Wirtschaftswunder, where dismantling industrial cartels and promoting competition formed the bedrock of economic policy. Ukraine’s transformation requires similar emphasis on institutional reform rather than simply directing resources toward particular sectors or firm categories.