Who bears the burden of tariffs? In light of recent tariffs on imports, policymakers, researchers, and the public have debated how tariff costs are distributed among foreign producers, domestic importers, trade intermediaries, and final consumers. While existing research suggests that import prices (inclusive of tariffs) tend to increase with tariffs, it remains unclear how these costs are transmitted to consumers. This paper resolves this disconnect by tracing tariff impacts on prices throughout the entire supply chain, from foreign producers through importers, distributors, and retailers to final consumers.

The authors examine US tariffs imposed on European wines in October 2019 as part of the Airbus-Boeing subsidy dispute. The policy levied a 25% tariff specifically on still wines with ≤14% alcohol by volume (ABV) from France, Germany, Spain, and the United Kingdom. Using confidential transaction-level data from a major wine importer matched to exporter and downstream distributor and retail prices, the researchers compare price changes for tariffed wines (still wines ≤14% ABV) against a control group of non-tariffed wines (still wines >14% ABV and sparkling wines) from producers that sold no tariffed products.

They find the following:

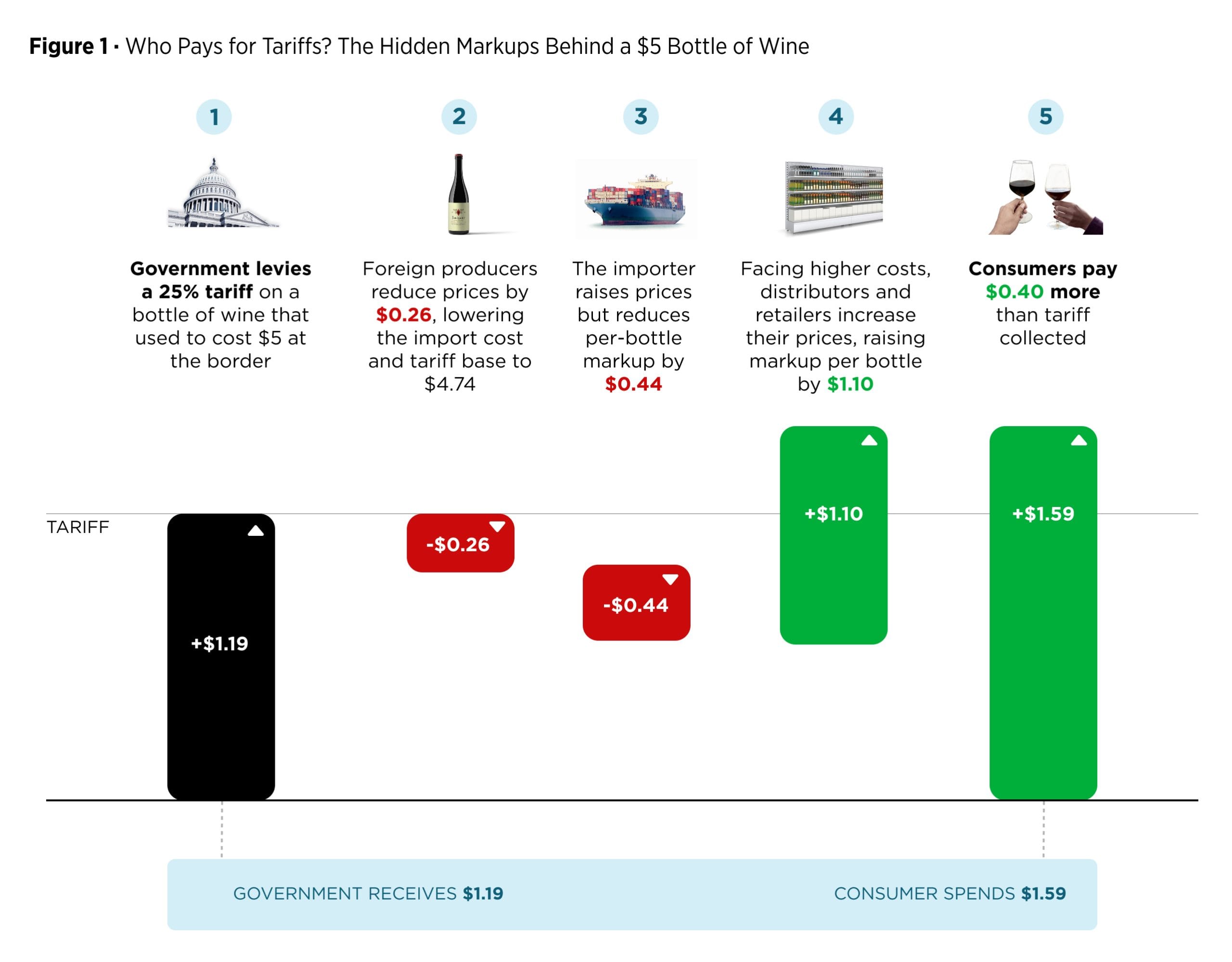

- Consumers paid more than the tariff in dollar terms. Foreign producers lowered their prices by 5.2% following the 25% tariff, absorbing roughly one-quarter of the tariff burden. However, because the producer’s price decline was much smaller than the 25% tariff rate, the importer still faced a net cost increase—paying a lower pre-tariff price but a higher tariff-inclusive price overall. As these costs moved through the supply chain, domestic markups amplified the price increase. The importer raised prices to distributors by 5.4%, absorbing some of the tariff through lower margins but passing most of the cost downstream. Retail prices ultimately rose by 6.9%. For a wine initially priced at $5 at the border, consumers paid $1.59 more per bottle while the government collected only $1.19 in tariffs—a dollar pass-through exceeding 100%. Even accounting for statistical uncertainty across all stages, the consumer dollar cost per dollar of tariff revenue exceeded 68% with 90% confidence.

- Price effects emerged gradually, taking nearly a year to reach consumers. Import prices began declining three months after tariffs took effect, as foreign suppliers adjusted their pricing. The importer’s prices to distributors increased around the same time. However, retail prices did not rise until approximately 10-12 months after the tariffs were imposed, and remained elevated well beyond when tariffs were suspended in March 2021. This lag structure reflects inventory management, contract timing, and the multiple stages goods traverse before reaching consumers.

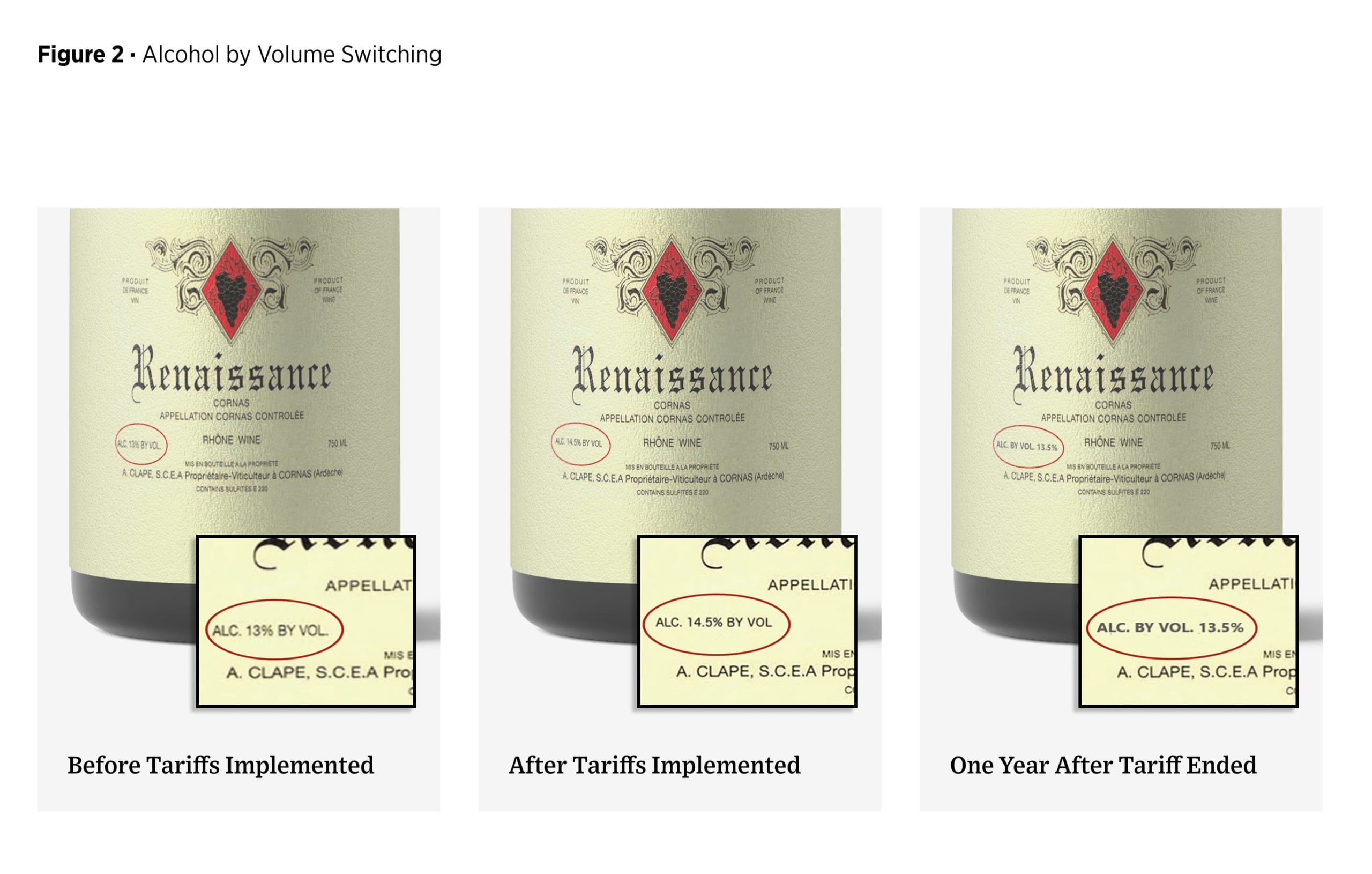

- Tariff engineering created compositional bias in trade statistics. Immediately after tariffs took effect, the share of new wine label applications for products >14% ABV from France jumped by 40 percentage points. Roughly one-quarter of this increase came from existing products switching their reported ABV from ≤14% to >14%, crossing the tariff threshold without necessarily changing the wine itself. This strategic relabeling demonstrates how firms adapt product characteristics to minimize tariff exposure and shows that standard unit value measures from customs data can produce misleading pass-through estimates when product composition shifts systematically.

These findings offer important lessons for policymakers evaluating trade policy, particularly as they interpret pass-through estimates for tariffs imposed in 2025. Conventional measures of tariff pass-through, expressed in percentage terms, can substantially understate the actual cost burden on consumers when goods pass through multiple distribution stages with significant markups. The timing of price adjustments also matters, as the nearly year-long lag before retail prices fully adjust means tariffs can influence inflation well after implementation. Finally, the systematic product reclassification to avoid tariffs demonstrates how firms strategically respond to trade policy through product adaptation rather than just pricing adjustments, potentially limiting revenue collection and distorting trade statistics.