- About

- Network

- Research Initiatives

- Big Data Initiative

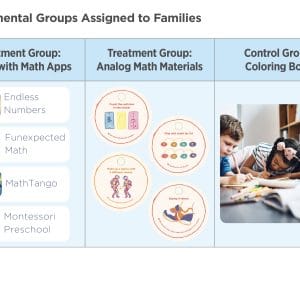

- Chicago Experiments Initiative

- Health Economics Initiative

- Industrial Organization Initiative

- International Economics and Economic Geography Initiative

- Macroeconomic Research Initiative

- Political Economics Initiative

- Price Theory Initiative

- Public Economics Initiative

- Ronzetti Initiative for the Study of Labor Markets

- Socioeconomic Inequalities Initiative

- Research Initiatives

- Scholars

- Research

- Social Dynamics of AI AdoptionLeonardo Bursztyn, Alex Imas, Rafael Jiménez-Durán, Aaron Leonard, and Christopher RothDo Test Scores Misrepresent Test Results? An Item-by-Item AnalysisJesse Bruhn, Michael Gilraine, Jens Ludwig, and Sendhil MullainathanComplexity Theory and Economic InequalitySteven Durlauf, David McMillon, and Scott Page

- Insights

Videos

BFI Youtube Channel

- Events

Upcoming Events

- News