Recent research seems to suggest that most US creditors lend money expecting repayment from a company’s cash flows: the movement of money into and out of a company over a certain period. If the company’s inflows of cash exceed its outflows, its net cash flow is positive. If outflows exceed inflows, it is negative. , with tangible assets: a physical item with a finite monetary value that can be touched and utilized (tangibility), such as land, buildings, or machinery, and is recorded on a company’s balance sheet serving merely as a secondary fallback when those flows prove inadequate. A corporation’s assets are less valuable, in other words, than the cash flows it expects to generate, at least when it comes to borrowing.

Along these lines, an important recent study shows that 80% of US corporate borrowing takes the form of cash-flow-based debt: debt that is not covered by specific assets, such as land or a piece of equipment. All unsecured debt is cash-flow-based debt; but so is debt with a general lien against assets. , rather than debt secured by specific assets. This shift toward cash-flow-based lending appears to reflect the increasing sophistication of American financial markets, where earnings-based covenants have become the primary tools for assessing borrowing capacity.

The new paper by Benmelech, Kumar, and Rajan challenges such an interpretation by examining the importance of assets to borrowing for relatively large US firms in recent decades.

The critical insight missing from recent analysis is that debt can be backed by assets even when those assets are not explicitly pledged as security. Large, established firms with substantial unpledged assets can issue unsecured debt: loans that are not backed by collateral. If the borrower defaults on the loan, the lender may not recover its investment because there are no pledged assets to be seized and sold. that is implicitly backed by their tangible assets, providing creditors with confidence while preserving corporate flexibility. This implicit backing represents a strategic choice rather than a limitation; financially strong firms often prefer to avoid secured borrowing, preserving their ability to pledge assets in future situations when financing might be much more difficult.

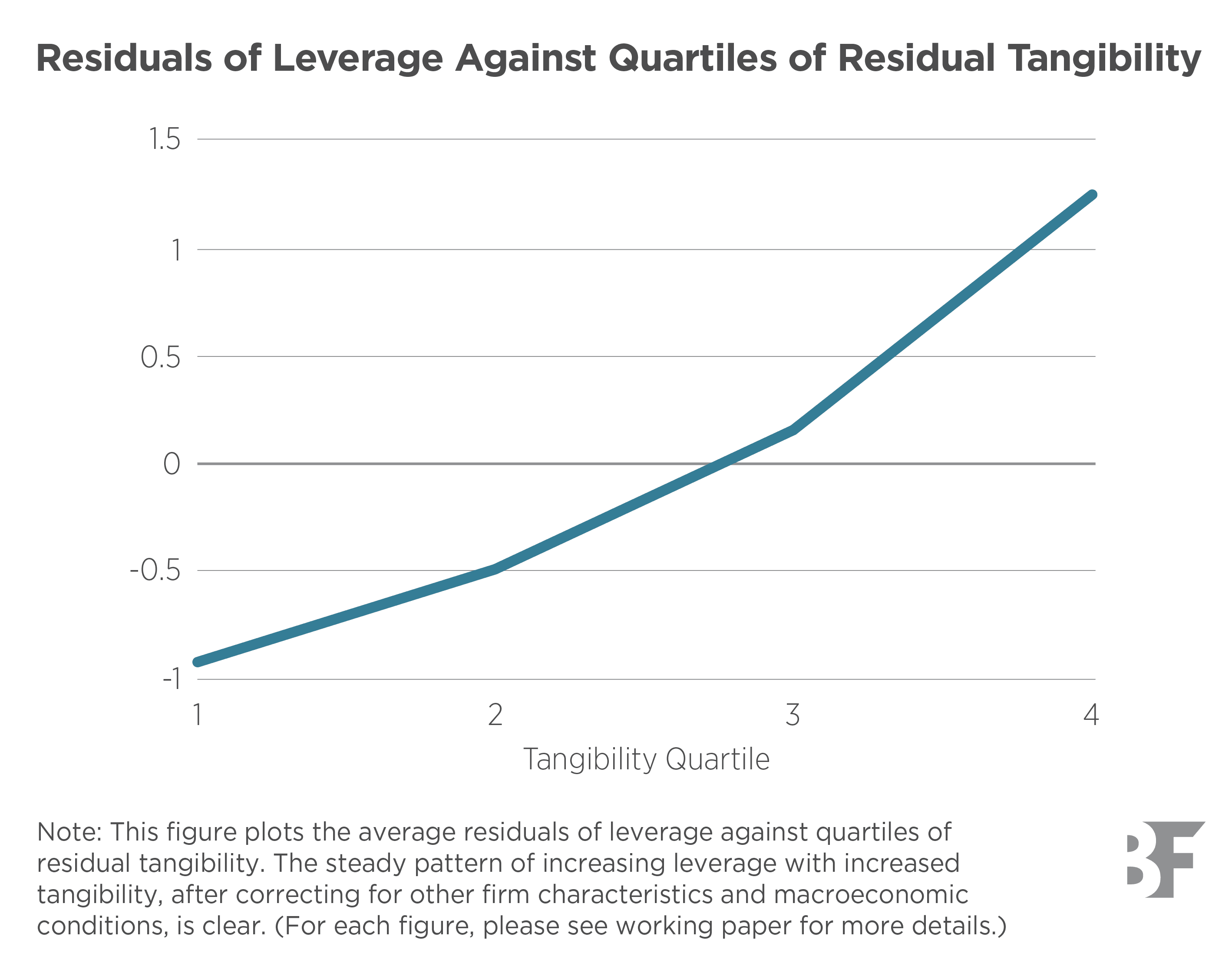

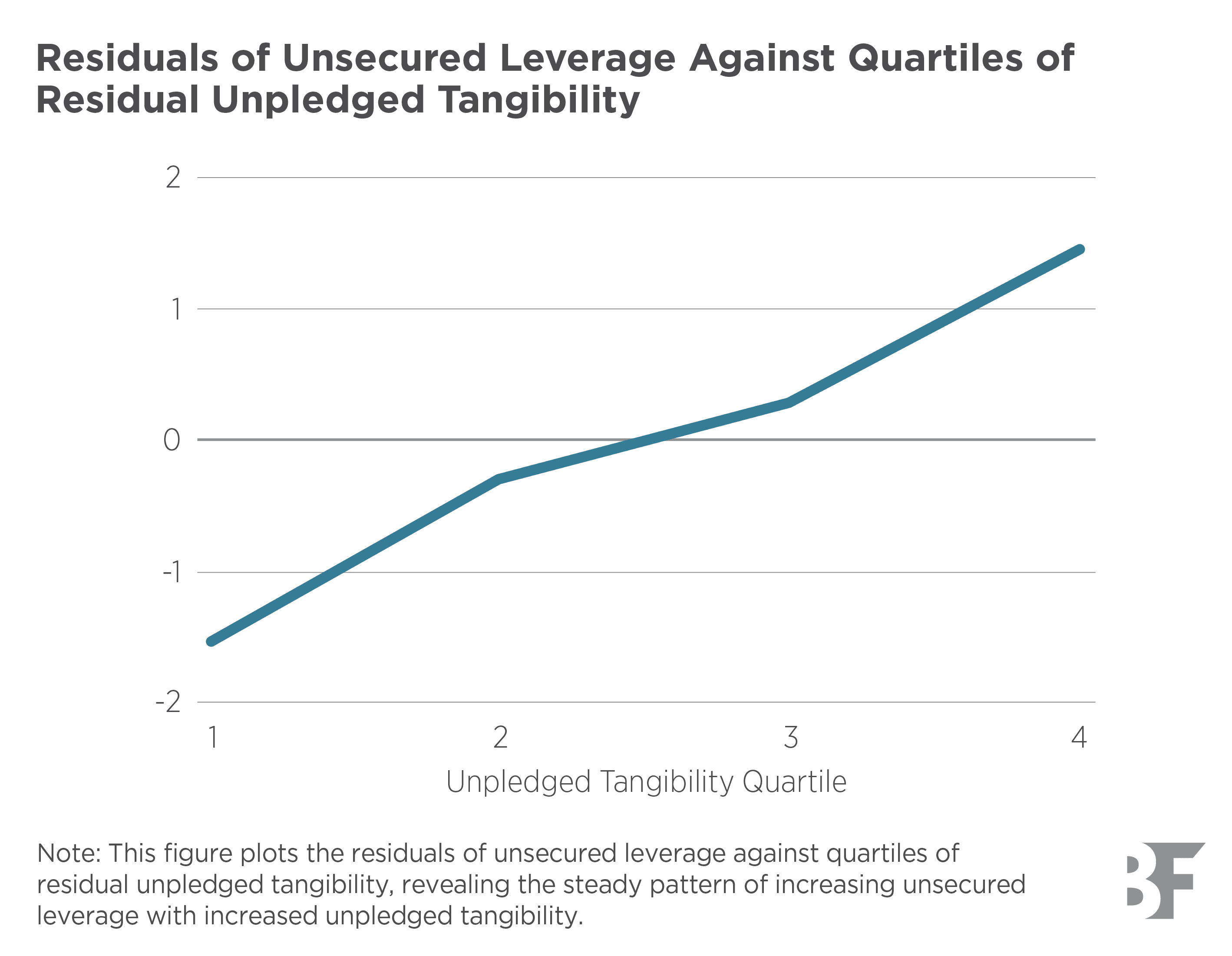

The trick is to detect and measure this implicit asset backing. Such efforts are hamstrung by methodological limitations. Simple correlations between unsecured debt and tangible assets often yield insignificant or even negative correlations, not because assets are unimportant, but because the analysis fails to account for the complex interactions between different types of debt and the varying financial constraints firms face. For example, when the researchers correct for assets already encumbered by secured debt, a strong positive correlation between unsecured debt and available unpledged collateral emerges clearly across the sample of firms.

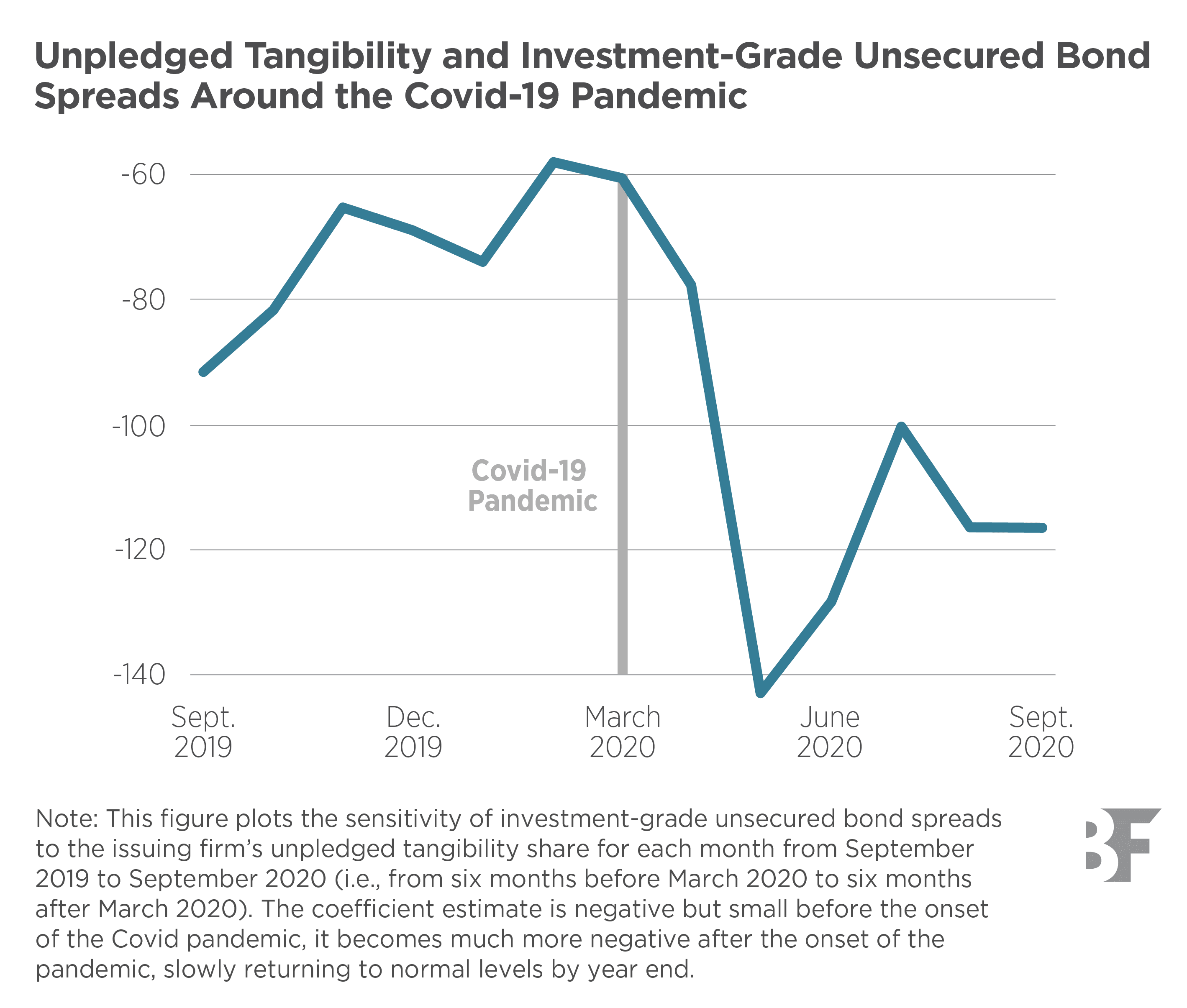

More revealing still is the evidence of how this relationship varies with economic conditions and firm circumstances. During periods of macroeconomic stress, the importance of implicit asset backing becomes more pronounced. Investment-grade firms: an investment-grade firm is a company with a high credit rating from a major credit rating agency like Standard & Poor’s (S&P), Moody’s, or Fitch. These ratings signify that the firm has a strong financial profile and a low risk of defaulting on its debt obligations. with substantial unpledged tangibility demonstrate increased debt issuance during economic downturns, and their borrowing spreads reflect the implicit value of their unencumbered assets, particularly during difficult times. This pattern suggests that asset backing is not a fixed characteristic of debt instruments but rather a dynamic feature that responds to changing conditions.

Unpledged assets can play different roles for different firms. For example, for financially strong firms operating under normal conditions, creditors primarily look to going-concern value: the value of a company generated in its continuing business activities rather than liquidation value: the worth of a company’s business activities and assets if it were to sell them in the event of going out of business for repayment assurance. The presence of substantial unpledged assets serves multiple functions in this context: it prevents destructive competition for collateral among creditors, enables access to debtor-in-possession financing: this financing allows companies that have filed for bankruptcy protection under Chapter 11 to borrow capital to restructure and continue trading. These loans usually have priority over existing debt, equity, and other claims and are facilitated in the hope that the distressed company, with a new cash injection, can save itself, begin making money again, and pay off all its debts. during potential reorganizations, and provides monitoring creditors with confidence that their claims could be fully secured if circumstances deteriorate. Even when debt remains unsecured throughout a firm’s reorganization, the going-concern value upon which repayment depends may be significantly enhanced by the availability of substantial collateralizable assets.

This analysis reveals the existence of three distinct but fluid categories of firms in the corporate debt market:

- The first category comprises financially constrained firms that must issue secured debt to borrow, explicitly pledging assets to obtain lender comfort.

- The second includes firms whose debt appears to be cash-flow-based but is implicitly backed by substantial unpledged assets, with the asset-debt relationship masked.

- Finally, the third category encompasses firms with such stable cash flows and high going-concern values that assets truly become secondary to debt capacity and borrowing decisions.

Membership in these categories is not permanent. The same debt instrument issued by the same firm can shift along the spectrum from cash-flow-based to asset-backed as corporate conditions and macroeconomic circumstances change. During favorable periods, a firm’s debt may rely primarily on cash flow expectations and going-concern value, but as conditions deteriorate, the implicit backing provided by unpledged assets becomes increasingly important to both debt capacity and pricing. Some unsecured debt even becomes explicitly secured during challenging times, demonstrating the fluid nature of these relationships.

This dynamic understanding has profound implications for both financial theory and practical application. The traditional binary classification of debt as either cash-flow-based or asset-based proves inadequate for capturing the sophisticated reality of modern corporate finance. Instead, most debt exists simultaneously in both categories, with the relative emphasis shifting based on firm-specific circumstances and broader economic conditions. This recognition suggests that phenomena such as the sale of assets at fire sale prices, the acceleration provided to investment when real estate prices increase, and the importance of collateral to borrowing in adverse situations remain highly relevant even in the most developed financial markets. Also, debt capacity can indeed depart from strict asset-value constraints during prosperous times.

The evolution of corporate debt structures reflects the broader sophistication of modern financial markets, but it also reveals the enduring importance of tangible assets in corporate finance. Rather than being replaced by cash-flow-based lending, asset backing has become more subtle and conditional, providing a form of financial insurance that becomes more valuable precisely when it is most needed and preserving flexibility when conditions are favorable. Understanding this dynamic relationship is essential for policymakers, lenders, and corporate managers navigating an increasingly complex financial landscape where the traditional boundaries between different types of debt continue to blur and evolve.

Leverage and Tangible Assets

The positive association between leverage and tangible assets is consistent with the notion that tangible assets serve as useful collateral that mitigate financing constraints and enhance firms’ debt capacity.