Insight·Apr 11, 2018

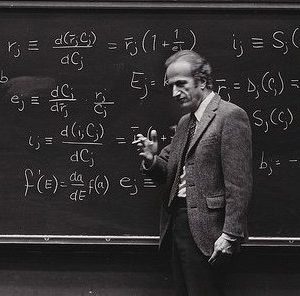

Discussion Section with Kevin Murphy, Featuring Lars Peter Hansen

Kevin Murphy talks with Lars Peter Hansen, the David Rockefeller Distinguished Service Professor and Director of BFI's Macro Finance Research Program, about BFI's beginnings, his research and more.