BFI Blackboard

Glossary

A

AAA-rated

The highest credit rating assigned to a company’s bonds, indicating an extremely low risk of default.

Inflation and Treasury Convenience

Adjustment Costs

In economics, these are expenses incurred when economic agents (like firms or individuals) change their decisions or actions, such as adjusting production levels, hiring or firing workers, or investing in new capital.

Economic Shocks and Healthcare Capital Investments

Administrative Records

Documents created by governmental agencies to support their mission activities, such as budget and finance, human resources, and facilities. Administrative records are collected for administrative purposes, such as registration, transaction, and record keeping, usually for the provision of public services.

Homelessness and the Persistence of Deprivation Income Employment and Safety Net Participation

Advance Purchase Agreements

Contracts in which buyers, typically governments, agree to purchase a product from a specific supplier in advance of its development or approval, providing firms with guaranteed demand.

Investing in Vaccines to Mitigate Harm from COVID-19 and Future Pandemics

Advanced Market Commitments

Agreements where governments or organizations commit to purchasing or subsidizing a product, like vaccines, once it is successfully developed, guaranteeing a market for manufacturers

Investing in Vaccines to Mitigate Harm from COVID-19 and Future Pandemics

Agglomeration Shadows

The negative impact on economic activity and city formation in areas surrounding large cities, where the concentration of businesses discourages growth in nearby locations

Dynamic Targeting: Experimental Evidence from Energy Rebate Programs

Agglomeration Spillovers

Economic benefits that firms gain from being close to each other, resulting in increased productivity

Dynamic Targeting: Experimental Evidence from Energy Rebate Programs

Algorithm

Simply put, algorithms are a set of instructions for a procedure or process that works for all procedures of that type. Algorithms are commonly used for calculations, data processing, and automated reasoning. Simple algorithms, for example, would be recipes, which provide specific instructions for a result. Similarly, a simple addition equation is an algorithm that takes two numbers, writes them vertically by aligning by place values, and then adds the numbers place wise.

Anti-Social Norm

A social norm that most people disapprove of normatively yet expect to be adhered to by a majority in equilibrium

Asset Pricing

The process of determining the fair value of financial assets based on their risk and expected return

B

Bankruptcy

A legal proceeding to address insolvency, initiated when a person or business (debtor) is unable to repay outstanding debts or obligations (to creditors). All the debtor’s assets are measured and evaluated and may be used to repay a portion of the outstanding debt.

A Commitment Rule for Insolvency Forum

Bankruptcy Efficiency

Designed by Djankov et al. (2008) and extended by World Bank (2020), this measure captures the fraction of enterprise value that can be preserved in bankruptcy.

Bankruptcy Resolution and Credit Cycles

Beveridge Curve

A graphical representation of the relationship between unemployment and the job vacancy rate, the number of unfilled jobs expressed as a proportion of the labor force. It typically has vacancies on the vertical axis and unemployment on the horizontal and slopes downward, as a higher rate of unemployment normally occurs with a lower rate of vacancies.

A Theory of How Workers Keep Up With Inflation

Binned Scatterplots

A graphical representation that groups data points into bins based on a variable and plots the average value of another variable within each bin to identify trends or relationships

Neoclassical Growth in an Interdependent World

Blind Review

A method where the reviewers of a paper, proposal, or research project do not know the identities of the authors, and often, the authors do not know the identities of the reviewers either

Blinded Versus Unblinded Review: A Field Study Comparing the Equity of Peer-Review

Bond Yields

The returns an investor earns from holding a bond, typically expressed as a percentage of the bond’s price

Movements in Yields, not the Equity Premium: Bernanke-Kuttner Redux

Breakeven Inflation

The expected inflation rate, calculated by comparing the returns of regular bonds to those of inflation-protected bonds

Brown Firms

Less sustainable than a green firm, that is, less inclined to consider such factors as carbon emission when weighing effects on earnings

Business Credit To GDP

A financial metric that measures the total amount of credit extended to businesses as a percentage of a country’s gross domestic product, or GDP

Bankruptcy Resolution and Credit Cycles

C

Civil Rights Act

The Civil Rights Act of 1964 outlawed discrimination based on race, color, religion, sex, or national origin in public places, schools, and employment, and established the Equal Employment Opportunity Commission.

The Social Construction of Race during Reconstruction

Closed-Economy Neoclassical Growth Model (CNGM)

An economic theory explaining how a country’s economic growth is driven by factors like capital, labor, and technology, without any external trade influences

Neoclassical Growth in an Interdependent World

Cognitive Skills

Brain functions used for thinking, paying attention, processing information, and remembering things. Some of these functions include sustained attention, auditory processing, and short-term memory

Early Predictors of Racial Disparities in Criminal Justice Involvement

Community-Rated Insurance

A type of insurance policy where the premiums are set at the same level for all policyholders within a specific group, regardless of individual claims history or health status

Access to Credit Reduces the Value of Insurance

Commuting Zones

Geographic area intended to more accurately reflect where people live and work

Lives vs. Livelihoods: The Impact of the Great Recession on Mortality and Welfare

Complements

Two factors that work better together than separately, where the presence of one enhances the effectiveness of the other.

Confidence Interval

A range that estimates where the true answer lies, with a certain level of certainty

Consumer Surplus

The difference between the amount consumers are willing to pay for a good or service and the amount they actually pay

Optimal Urban Transportation Policy: Evidence from Chicago

Consumption Poverty

A measure of poverty where a household’s consumption expenditures, reflecting actual living standards, fall below a specified poverty threshold

Poverty, Hardship, and Government Transfers

Consumption Smoothing

Maintaining stable consumption levels in response to unexpected financial shocks

Access to Credit Reduces the Value of Insurance

Continuous Ranked Probability Score

A measure of how surprising an event is compared to what was expected

What is Newsworthy? Theory and Evidence

Convenience Yield

The extra value or benefit of holding an asset, like U.S. Treasury bonds, due to its safety, liquidity, or ease of use in transactions

Inflation and Treasury Convenience

Cost-Benefit Analysis

A systematic process used to analyze which decisions to make, for example, and which to forgo. A cost-benefit analyst sums the potential rewards expected from a situation or action and then subtracts the total costs associated with taking that action, accounting for the fact that the rewards and costs may occur over different time horizons.

Marginal Returns to Public Universities

Counterfactual Scenarios

Hypothetical scenarios used in analysis to understand what would have happened if a certain event or intervention had not occurred, helping to isolate the impact of specific policies

Poverty, Hardship, and Government Transfers

Creative Destruction

The process of innovation and technological change where new products, processes, or business models replace older ones, leading to the dismantling of established industries and ways of life

Engineering Ukraine’s Wirtschaftswunder

Credit Booms

An expansion of credit in an economy

Bankruptcy Resolution and Credit Cycles

Cross-Randomize

A method in experimental design where different groups receive different combinations of treatments or interventions, allowing for the study of multiple variables simultaneously

Cryptocurrency

This is a peer-to-peer digital payment system that doesn’t rely on banks to verify transactions. Cryptocurrency payments exist purely as digital entries to an online database describing specific transactions that are recorded in a public ledger.

Cryptocurrency

This is a peer-to-peer digital payment system that doesn’t rely on banks to verify transactions. Cryptocurrency payments exist purely as digital entries to an online database describing specific transactions that are recorded in a public ledger.

Currency Crisis

A sudden and steep decline in the value of a nation’s currency, which causes negative ripple effects throughout the economy. Unlike a currency devaluation as part of a trade war, a currency crisis is not a purposeful event. The value of a currency is tied to a country’s economic health, so a sudden drop in its value often indicates severe problems

Currency Intermediation Shocks

A disruption in financial markets that impacts exchange rates, such as a change in financial institutions’ willingness to intermediate currency trades or a global flight to the safety of the U.S. dollar

Exchange Rates, Natural Rates, and the Price of Risk

Customer Capital

A component of intangible capital representing investments in building and maintaining customer relationships, including sales, marketing, and customer data

D

Difference-in-Differences

A statistical method that estimates the causal effect of a treatment or shock by comparing changes over time between an affected group and a similar but unaffected control group

Supply Chain Shocks and Firm Productivity: The Role of Reporting Quality

Directed Migration

As described above, this is the authors’ term to describe the relationship between population growth and income per capita across states. Labor is “directed” to move to regions of relatively higher income per capita, thus increasing income convergence.

Why Has Regional Income Convergence in the U.S. Declined?

Disability Insurance

Provides monthly payments to people who have a disability that stops or limits their ability to work. SSDI is administered by the Social Security Administration

Homelessness and the Persistence of Deprivation: Income, Employment, and Safety Net Participation

Discount

In a financial sense, to discount the future value of a currency is to determine the present value of future cash flows. This is a method of calculating the value of money in the future, based on the assumption that money is worth more today than in the future.

Discount Rate

The rate used to determine the present value of future cash flows, indicating how much future money is worth today

Disposable Income Poverty

A measure of poverty where a household’s income, including after-tax earnings, non-cash benefits, and tax credits falls below a designated poverty threshold, with deductions for state and federal taxes

Poverty, Hardship, and Government Transfers

Dissaving

Spending more than current income

Poverty, Hardship, and Government Transfers

Dividend Futures Prices

The prices of contracts that allow investors to bet on or hedge against the future dividend payments of a company or stock index

Movements in Yields, not the Equity Premium: Bernanke-Kuttner Redux

Dollar/G10 Exchange Rate

An index representing the average exchange rate between the U.S. dollar and the G10 currencies (those of Australia, Canada, Denmark, the Euro area, Japan, New Zealand, Norway, Sweden, Switzerland, and the United Kingdom)

Exchange Rates, Natural Rates, and the Price of Risk

Domestic Capital

The stock of assets owned by corporations in the United States

Tax Policy and Investment in a Global Economy

Domestic Investment

Corporate spending on assets within the United States

Tax Policy and Investment in a Global Economy

Double-Blind Review

A process where both the identities of the reviewers and the authors are kept hidden from each other

Blinded Versus Unblinded Review: A Field Study Comparing the Equity of Peer-Review

Downward Income Mobility

The tendency to earn less than one’s parents

The Evolution of Black-White Differences in Occupational Mobility Across Post-Civil War America

Dynamic Interventions

A treatment strategy that adapts and optimizes assignments over time based on observed responses and updated information

Dynamic Targeting: Experimental Evidence from Energy Rebate Programs

E

Earned Income Tax Credit

A refundable tax credit aimed at supporting low- to moderate-income working individuals and families by reducing their tax burden and providing additional income

The Claiming of Children on U.S. Tax Returns

Economies Of Scale

Cost advantages that occur when increasing production leads to lower cost per unit

The Curious Surge of Productivity in U.S. Restaurants

Endogenous

In economics, an endogenous variable is a variable in a model that is determined by its relationship with other variables in the model. Endogenous variables are also known as dependent variables.

Global Hegemony and Exorbitant Privilege

Enforcement Decisions and Orders, or EDOs

Directives issued by regulatory agencies to force a financial institution or individual to take corrective actions to comply with laws and regulations, resolve violations, or prevent unsafe practices.

Enterprise Value

A measure of a company’s total value, calculated as the market value of equity plus debt, minus cash, representing its overall worth to investors

Entrants

A business that attempts to sell a particular product or service in a market dominated by an incumbent firm

Spatial Competition, Strategic Entry Responses, and the North Dakota Railroad War of 1905

Environmental, Social, And Governance (ESG)

Shorthand for environmental, social, and governance, “ESG” refers to a set of standards often used by investors to evaluate companies’ activities related to sustainability, social good, and corporate governance

How Do Consumers Use Firm Disclosure? Evidence from a Randomized Field Experiment

Equity Premium

The additional return that investors expect to earn from stocks over less risky assets, like government bonds, to compensate for higher risk

Movements in Yields, not the Equity Premium: Bernanke-Kuttner Redux

Event Study

A statistical method used to assess the impact of an event on an outcome of interest

Moving to Opportunity, Together

Ex Ante

Before

Is There Too Little Antitrust Enforcement in the US Hospital Sector?

Ex Post

After

Is There Too Little Antitrust Enforcement in the US Hospital Sector?

Exchange Mobility

Changes in an individual’s income or occupational status due to personal advancements or setbacks, while the overall distribution of income and occupational roles remains unchanged

The Evolution of Black-White Differences in Occupational Mobility Across Post-Civil War America

Exchange Rate Pegging

A monetary policy where a country’s currency value is fixed to another currency, a basket of currencies, or a commodity like gold to provide exchange rate stability

Bankruptcy Resolution and Credit Cycles

Exchange-Traded Funds

Also known as ETFs, these are funds that contain bundles of assets, such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold. ETFs trade on stock exchanges that can be bought and sold like a common stock. Such bundled assets potentially lower your risk and exposure, while helping to diversify a portfolio.

Exogenous

Exogenous variables are the opposite of endogenous variables, which are independent variables that are determined outside of the model and cannot be predicted by the model

Global Hegemony and Exorbitant Privilege

Expected Inflation

The rate at which prices are predicted to increase

Experience-Rated Insurance

A type of insurance policy where the premiums are adjusted based on the claims history of the policyholder

Access to Credit Reduces the Value of Insurance

Externalities

A cost or benefit that affects a third party that is not directly involved in an economic activity. Externalities can be positive or negative, and they can be caused by production or consumption.

F

Factor Analysis

A statistical method used to reduce the number of variables and identify patterns by grouping variables into factors

Fallow

When land is left unseeded or unharvested to restore its fertility (as opposed to being continually cultivated)

Fallow Lengths and the Structure of Property Rights

Field Experiments

A study conducted in a real-world setting where researchers manipulate one or more independent variables to observe the effect on an outcome of interest

Toward an Understanding of the Political Economy of Using Field Experiments in Policymaking

Financial Crisis of 2007-09

Largely attributable to a housing market bubble driven by subprime mortgages, the Financial Crisis of 2007-2009 was a period of severe economic downturn and financial market stress that originated in the United States and quickly spread globally. It was the most significant economic downturn since the Great Depression of the 1930s, earning it the moniker, “Great Recession.”

Financial Markets

Venues where buyers and sellers participate in the trading of assets such as stocks, bonds, currencies, and derivatives

Financial Shocks

Sudden, disruptive changes in economic conditions or personal finances

Access to Credit Reduces the Value of Insurance

Fiscal Rules

Government-imposed restrictions on budgetary policies, typically aimed at limiting public debt, deficits, and expenditures

Fixed Costs

Expenses that remain constant, regardless of changes in a business’s production volume or sales levels

Forbearance

A temporary regulatory allowance that lets banks delay recognizing losses or meeting certain financial requirements to help them remain solvent during crises

Foreign Capital

The stock of assets that United-States-based companies own outside of the United States

Tax Policy and Investment in a Global Economy

Franchise Value

The present value of a bank’s future profits from lending and deposit-taking net of operating costs

Freedmen’s Savings Bank

The Freedman’s Saving and Trust Company, known as the Freedman’s Savings Bank, was a private savings bank chartered by the US Congress in 1865 to collect deposits from the newly emancipated communities. The bank opened 37 branches across 17 states and Washington, D.C., within 7 years and collected funds from over 67,000 depositors. The bank failed due to White managers’ mismanagement, fraud, and risky investments that were exposed during financial stress.

The Social Construction of Race during Reconstruction

Frictions

Impediments that prevent markets from operating perfectly and efficiently, leading to suboptimal outcomes and deviations from ideal market behavior

Competitive Job Seekers: When Sharing Less Leaves Firms at a Loss

Fundamental Credit Booms

An increase in lending driven by strong economic growth and sound financial conditions

Bankruptcy Resolution and Credit Cycles

G

General Equilibrium Effects

The broad economic impacts that arise when changes in one market or policy influence other interconnected markets and agents in the economy.

Disemployment Effects of Unemployment Insurance: A Meta-Analysis

Gini Coefficient

A measure of income inequality, where 0 represents perfect equality and 1 (or 100%) represents maximum inequality

Disease, Disparities, and Development: Evidence from Chagas Disease Control in Brazil

Green Firms

A green firm, also known as a sustainable business, is a company that prioritizes the health of the planet while still earning a profit. Green firms aim to reduce their negative environmental impact by incorporating sustainable practices into their business decisions.

H

Hegemon

In global relations, a hegemon is a dominant power, often defined by military strength, but also including economics and other factors.

Global Hegemony and Exorbitant Privilege

Herfindahl–Hirschman Index

A widely used measure of market concentration in economics and antitrust analysis that is calculated by summing the squares of the market shares of all firms in a market, with the resulting index ranging from 0 (perfect competition) to 10,000 (monopoly)

Painful Bargaining: Evidence from Anesthesia Rollups

Holding Company

A business entity that holds controlling stock in other companies; it does not manufacture products or otherwise sell any products or services

A Commitment Rule for Insolvency Forum

Human Capital

The collective skills, knowledge, and abilities of individuals that can be used to create economic value.

Does Nothing Stop a Bullet Like a Job? The Effects of Income on Crime

Hyperinflation

This term describes rapid, excessive, and out-of-control general price increases in an economy, often used to describe inflation measuring more than 50% per month.

Hysteresis

In global politics, hysteresis can mean that a country retains its dominant position even after the factors that led to that event have been removed or otherwise run their course. Similarly, in economics, the state of an economy can persist after foundational factors have expired.

Global Hegemony and Exorbitant Privilege

I

Imperfect Substitutability

“Imperfect substitutability” refers to the idea that goods and capital from different countries are not perfect replacements for each other. Due to factors like quality, characteristics, or regulatory differences, a good or capital from one country cannot seamlessly substitute for that from another in international trade and investment.

Neoclassical Growth in an Interdependent World

Incentive-Compatible

In game theory and economics, incentive compatibility refers to a situation where individuals have an incentive to reveal their true preferences or act in a way that aligns with the desired outcome of a system or policy. Essentially, it means that the mechanism is designed in such a way that it is beneficial for individuals to be truthful.

Mechanism Design of Personalized Policy: A Field Experiment Incentivizing Exercise

In-Kind Transfers

In lieu of cash, a government agency may provide welfare support by distributing, for example, housing vouchers or nutrition assistance.

Homelessness and the Persistence of Deprivation

Income Gap

A measure of a bank’s exposure to interest rate risk, defined by the difference between the share of assets and liabilities that reprice within a given time horizon.

Income Shocks

One-time, unexpected changes in how much money an individual or firm earns or has.

Economic Shocks and Healthcare Capital Investments

Incumbent Firms

A business already established in a market or industry, especially one with a significant market share that typically brings several advantages over competitors.

Spatial Competition, Strategic Entry Responses, and the North Dakota Railroad War of 1905

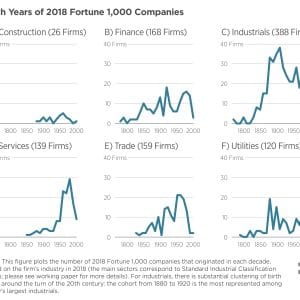

Industrial Firms

Firms in manufacturing and mining industries according to the Standard Industrial Classification codes, which are four-digit codes that classify a company by its economic activity.

Superstar Firms Through the Generations

Industrial Policies

Government measures aimed at stimulating economic growth and development within specific sectors or industries by providing targeted support, such as subsidies, tax incentives, or regulatory adjustments.

Industrial Policies and Innovation: Evidence from the Global Automobile Industry

Inefficiencies

Instances where resources are not allocated optimally, leading to a loss of potential economic welfare.

Blinded versus Unblinded Review: A Field Study Comparing the Equity of Peer Review

Inefficient Liquidation

The process of selling a company’s assets for less than their optimal value.

Bankruptcy Resolution and Credit Cycles

Inflation

The rate at which the general level of prices for goods and services rises, eroding purchasing power.

Information Frictions

The barriers or challenges in the flow of information, which can result from factors like complexity, inaccessibility, lack of transparency, or inefficient communication channels.

How Do Consumers Use Firm Disclosure?

Information Intervention

A strategy where targeted information is provided to influence individuals’ decisions or behaviors, often to improve decision-making or correct misconceptions.

Social Interactions, Information, and Preferences for Schools

Information Treatment

The process of providing participants with specific information or data to observe how this input affects their behavior, decisions, or perceptions.

Do Information Frictions and Corruption Perceptions Kill Competition?

Insolvency

A financial state wherein an individual or company can no longer meet their financial obligations. An insolvent company or person may establish arrangements with creditors to, for example, set up alternative payment arrangements. Insolvency can lead to bankruptcy.

A Commitment Rule for Insolvency Forum

Intangible Capital

Non-physical assets that contribute to a firm’s value, such as brand reputation, intellectual property, and customer relationships.

Intendants/Intendancy

Developed in France and applied by Spain to its colonial empire under the Bourbon reforms of the 18th century, intendancies were centralizing administrative systems. Regions were divided into districts, with each administered by an intendant who was appointed by the Crown. With wide-ranging powers that gave them a say in almost all administrative, ecclesiastical and military matters, intendants were conceived as a check on previous local officials who had engaged in corruptive behavior, including exploitation of indigenous communities.

The Social Construction of Race during Reconstruction

Intergenerational Income Mobility

The extent to which children’s economic outcomes differ from those of their parents, measuring whether advantage or disadvantage passes from one generation to the next.

The Evolution of Black-White Differences in Occupational Mobility

Internal Rate Of Return (IRR)

The discount rate at which the net present value of an investment is zero, indicating its profitability.

Disease Disparities and Development

J

Jim Crow

In the wake of Reconstruction’s demise in 1877, state and local governments devised laws to institutionalize racial segregation and discrimination. These laws persisted until federal Civil Rights legislation nearly 100 years later.

The Social Construction of Race during Reconstruction

L

Land Titling

The legal process of officially recognizing and documenting the ownership rights of individuals or groups over parcels of land.

Fallow Lengths and the Structure of Property Rights

Leveraged Buyouts (LBOs)

A financial transaction where a company is acquired using a large amount of borrowed money, rather than the buyer’s own capital. The buyer uses debt, or leverage, to finance a significant portion of the acquisition, often with the assets of the company being acquired as collateral.

Managing Margins: PE Effects on Financial, Physical, and Human Capital

Liquid

An asset that can be easily and quickly converted into cash without significant loss of value.

Inflation and Treasury Convenience

Load Shifting

The practice of moving energy consumption from periods of high demand to periods of lower demand.

Toward an Understanding of the Economics of Prosumers

Long-Term Securities

Financial assets, such as bonds or mortgage-backed securities, that mature over an extended period (typically more than a year) and are sensitive to interest rate changes.

M

Marginal Cost

The change in the total cost that results from producing one additional unit of a good or service.

Blinded versus Unblinded Review

Marginal Value of Public Funds (MVPF)

The MVPF is designed to measure long-run policy effectiveness. It is calculated as the ratio of two numbers: the benefits that the policy provides, divided by the government cost. The numerator (benefits) captures the extent to which the policy improves the lives of beneficiaries (described by economists as individuals’ “willingness to pay”), and the denominator reflects net government cost.

Market Failure

A situation where the market fails to allocate resources efficiently, leading to outcomes where the private sector’s incentives do not align with the broader social good, often justifying government intervention.

Investing in Vaccines to Mitigate Harm

Match Effects

The unique, job-specific value that arises from the interaction between a particular worker and a particular firm, beyond what can be attributed to the characteristics of either party alone

Firm Premia and Match Effects in Pay vs. Amenities

Mechanism Design

Focuses on designing rules, or “mechanisms,” that incentivize individuals to reveal their private information and achieve desired outcomes, even when those individuals act in their own self-interest. In other words, you start with a desired goal and work backward to create a system that achieves it.

Mechanism Design for Personalized Policy: A Field Experiment Incentivizing Exercise

Mental Model

Simplified frameworks or sets of assumptions that individuals use to understand and predict economic behavior and outcomes.

Monetary Policy

A set of actions taken by a central bank or government to influence the amount of money in the economy and the cost of borrowing.

Movements in Yields, Not the Equity Premium

Moral Hazard

In this context, a situation where a worker changes their work or job search behavior due to the availability of benefits.

Effects of Unemployment Insurance for Self-Employed and Marginally Attached Workers

N

Natural Field Experiment

A study in which researchers control the assignment mechanism in the field in a covert manner.

Toward an Understanding of the Economics of Prosumers

Negative Shocks

An unexpected event that has a detrimental impact on the economy, potentially leading to decreased output, increased unemployment, and higher prices, for example

Economic Shocks and Healthcare Capital Investments

Network Effects

A phenomenon where the value of a good or service increases as more people use it

Measuring Markets for Network Goods

NIL (name, image, and likeness)

Refers to a student-athlete’s ability to profit from their name, image, and likeness—elements of their personal brand. This concept is rooted in the “right of publicity,” which gives individuals control over how their identity is used for commercial purposes. In July 2021, new rules and state laws began allowing college athletes to earn money through sponsorships, endorsements, social media, and other business ventures.

The Benefits of Scholastic Athletics

Nominal

The stated or face value of something, like money or interest rates, without adjusting for inflation.

Nominal Wages

Wages measured in current dollars, without adjusting for inflation.

Why Do Workers Dislike Inflation?

Non-Cognitive Skills

Sometimes referred to as “soft skills,” these are brain functions related to motivation, integrity, and interpersonal interaction. These skills are associated with an individual’s personality, temperament, and attitudes.

Early Predictors of Racial Disparities in Criminal Justice Involvement

Nonfundamental Credit Booms

An increase in lending driven by speculation and unsound financial conditions, not supported by sustainable growth.

Bankruptcy Resolution and Credit Cycles

Null Results

When a study or experiment does not find a statistically significant effect or relationship between the variables being tested. This means the data does not provide evidence to reject the null hypothesis (the assumption that there is no effect or relationship).

Political Economy of Using Field Experiments in Policymaking

O

Occupational Mobility

The tendency for a person’s job position to change relative to their parents’.

The Evolution of Black-White Differences in Occupational Mobility

Opportunity Costs

The loss of potential gain from other alternatives when one alternative is chosen.

P

Percentile Rank

A statistical measure indicating the percentage of scores in a distribution that a specific score is greater than or equal to.

English Language Requirement and Educational Inequality

Poisson Random Variable

A type of statistical distribution that is used to model the number of times an event happens in a fixed interval of time or space.

Quantifying the Social Value of a Universal COVID-19 Vaccine

Policy Targeting

Directing specific interventions toward certain groups or areas to achieve optimal outcomes.

Dynamic Targeting: Experimental Evidence from Energy Rebate Programs

Positive Duration

A measure of interest rate sensitivity indicating that an asset’s value declines when interest rates rise.

Positive Shocks

An unexpected event that leads to a beneficial increase in economic activity, such as increased production, lower prices, or higher employment, often stemming from either increased demand or supply.

Economic Shocks and Healthcare Capital Investments

Present Value

The value today of an amount of money in the future. If the appropriate interest rate is 10 percent, then the present value of $100 spent or earned one year from now is $100 divided by 1.10, which is about $91.

Principal-Agent Problems

The principal-agent problem is a conflict of interest that occurs when one person or entity acts on behalf of another person or entity. It can arise in many situations including, for example, from the relationship between a client and a lawyer to the relationship between stockholders and a CEO.

Managing Margins: PE Effects on Financial, Physical, and Human Capital

Private Equity (PE)

Investment partnerships that buy and manage companies before selling them. Private equity firms operate investment funds on behalf of investors.

Managing Margins: PE Effects on Financial, Physical, and Human Capital

Product Proliferation

A strategy used by companies to increase the number of products they offer in a market, often to ward off entrants. This can involve introducing new products or making minor modifications to existing products.

Spatial Competition, Strategic Entry Responses, and the North Dakota Railroad War of 1905

Progressive

A tax system wherein the average tax rate increases as income increases.

Managing Margins: PE Effects on Financial, Physical, and Human Capital

Prosumers

An individual or business that both produces and consumes within a specific market

Toward an Understanding of the Economics of Prosumers: Evidence from a Natural Field Experiment

Pull Funding

Incentive-based funding that rewards firms after achieving specific results or delivering a successful product.

Investing in Vaccines to Mitigate Harm from COVID-19 and Future Pandemics

Push Funding

Financial support provided upfront to fund research, development, or production costs before the outcome is known.

Investing in Vaccines to Mitigate Harm from COVID-19 and Future Pandemics

Q

Qph: (Enterprise Value To Physical Capital Ratio)

A metric assessing how much value a firm generates relative to its tangible (physical) assets.

Quartile

A statistical term that refers to one of the three values that divide a data set into four equal parts, each containing 25% of the data points.

Bankruptcy Resolution and Credit Cycles

Quasi-Randomly

Assignment that resembles randomness, but is not truly random.

Banking on Trust: Supervisory Transparency and Depositors’ Actions

R

Random Walk

As noted in the text, when describing expected future prices (in this case cryptocurrencies but often applied to the stock market), random walk theory states that the expected future price is the current price. In other words, such prices are random, so that past movement or trend of a stock price or market cannot be used to predict its future movement.

Randomized Controlled Trial

A scientific study in which participants are randomly assigned to either a treatment group receiving the intervention being tested or a control group receiving a placebo or standard treatment. This method is used to objectively evaluate the effectiveness of a new treatment or intervention.

Competitive Job Seekers: When Sharing Less Leaves Firms at a Loss

Real

The value of money or interest rates after removing the effects of inflation, showing the true purchasing power.

Real Consumption

The total amount of goods and services consumed, adjusted for inflation to reflect true purchasing power.

The Curious Surge of Productivity in U.S. Restaurants

Real Investment

The spending on capital, such as equipment or buildings, after removing the effects of inflation, representing the actual value of goods purchased.

Real Labor Productivity

The amount of inflation-adjusted output (e.g., sales or visits) produced per worker.

The Curious Surge of Productivity in U.S. Restaurants

Real Required Return To Capital

The profit a company needs from an investment after adjusting for inflation.

Real Wages

Wages adjusted for inflation, reflecting purchasing power.

Why Do Workers Dislike Inflation?

Reconstruction Era

The Reconstruction era (1865-1877) in the United States followed the Civil War and focused on reintegrating the former Confederate states into the Union while defining the legal status of formerly enslaved people. Reconstruction was abandoned following the disputed election of 1876, which was resolved when the Republican candidate, Rutherford B. Hayes, agreed to end Reconstruction, thus ensuring Congressional approval of his presidency.

The Social Construction of Race during Reconstruction

Regional Income Convergence

Regional income convergence, also known as the “catch-up effect,” refers to the economic theory that poorer regions tend to grow faster than richer ones, eventually leading to a narrowing of the income gap.

Why Has Regional Income Convergence in the U.S. Declined?

Regressive

A tax system wherein the average tax rate goes down as income increases.

How Much Does the U.S. Fiscal System Redistribute?

Replacement Rate

The percentage of a worker’s previous earnings that is covered by unemployment benefits during a period of joblessness.

Disemployment Effects of Unemployment Insurance: A Meta-Analysis

Reservation Wage

The lowest wage rate at which a worker would be willing to accept a particular type of job.

Retail Customers

In banking, retail customers are individual consumers, rather than businesses, who receive financial services from a bank, including access to credit and borrowing, deposit opportunities, and money management advice.

Retail Deposit

These are deposits in a financial institution placed by an individual or household, as opposed to those that derive from wholesale funding.

Road Pricing

A transportation policy that imposes charges on drivers to manage traffic flow and reduce congestion.

Optimal Urban Transportation Policy: Evidence from Chicago

Roll Up

A business strategy where a firm consolidates smaller companies in the same industry to create efficiencies or gain market power, often leading to increased market concentration and higher prices.

S

Safety Net

Generally understood as government programs that protect low-income and/or homeless citizens, including elements of Social Security like Supplemental Security Income and Disability Insurance, and Medicare, Medicaid, Unemployment, and Welfare Programs, among others.

Homelessness and the Persistence of Deprivation: Income, Employment, and Safety Net Participation

Sampling Error

The difference between a sample estimate and the true population value due to random fluctuations.

Understanding the Heterogeneity of Intergenerational Mobility across Neighborhoods

Second Industrial Revolution

A period from around 1860 to 1900, marked by advancements in steel, electricity, and petroleum, and giving rise to large-scale industrialization and major corporations.

Superstar Firms Through the Generations

Selection Bias

Selection bias in a research study occurs when non-random data is selected for statistical analysis, which can lead to inaccurate conclusions when comparing the study sample to the population of interest or comparing different subsamples of individuals to each other.

Marginal Returns to Public Universities

Significant

Often refers to statistical significance, which is a measure of whether a result is unlikely to have occurred by chance and instead is attributable to a real effect or difference.

Experimental Estimates of College Coaching on Postsecondary Re-enrollment

Silicon Valley Bank Failure

The Silicon Valley Bank (SVB) crisis was the third-largest US bank failure in history, occurring in March 2023 after a run on deposits led to its seizure by regulators. The crisis was triggered by the bank’s large portfolio of long-term, low-yield securities that lost significant value when the Federal Reserve raised interest rates to control inflation. This, combined with a downturn in the tech sector and widespread panic, caused customers to rapidly withdraw funds, prompting the bank to sell assets at a loss, and ultimately leading to its collapse.

Single-Blind Review

A process where the identities of the reviewers are hidden from the authors, but the reviewers are aware of the authors’ identities.

Blinded Versus Unblinded Review: A Field Study Comparing the Equity of Peer-Review

Social Benefit

The positive impact of an action, policy, or project on society as a whole. Unlike private benefits, which accrue directly to an individual or a specific organization, social benefits are broader and often affect a large segment of the population or the entire community. In this research, the authors measure the social benefit from reduced mortality.

Quantifying the Social Value of a Universal COVID-19 Vaccine and Incentivizing Its Development

Social Returns

The benefits that society receives from a policy, including both the private returns that accrue to individual beneficiaries and the positive externalities that accrue to others.

Blinded Versus Unblinded Review: A Field Study Comparing the Equity of Peer-Review

Socioeconomic Status

The social standing or class of an individual or group, often measured as a combination of education, income, and occupation.

Early Predictors of Racial Disparities in Criminal Justice Involvement

Sorting

This is the phenomenon driven by such forces as markets and regulation whereby individuals, households, businesses, and other agents make choices. For example, households may sort across neighborhoods according to their wealth and their preferences for public goods, social characteristics, and commuting opportunities. Individuals may sort in marriage markets according to looks, wealth, status, education, among other factors. Companies may sort based on labor quality and quantity, transportation costs, regulations, taxes, and so on.

Spanish Bourbon Dynasty

The House of Bourbon, French in origin, was enthroned in Spain upon the death of Charles II, the last Habsburg monarch, in 1700. The Bourbon Dynasty has reigned in Spain for more than three centuries until the present day, except for a period of two Republics, and the Franco dictatorship.

Bourbon Reforms and State Capacity in the Spanish Empire

Spatial Regression Discontinuity

An experimental design that estimates causal effects using geographic or spatial boundaries, where units on either side of the boundary experience different treatments.

Fear and Dreams: Understanding the Non-Institutional Sources of Leader Strategy

Spatial Sorting

The phenomenon where individuals arrange themselves across a geographic area based on preferences or characteristics, often influenced by factors like socioeconomic status or amenities.

Location Sorting and Endogenous Amenities: Evidence from Amsterdam

Spatial Strategic Competition

There are many forms of potential strategic behavior among incumbent firms and potential entrants into a market. Depending on conditions, incumbents may have an incentive to respond pre-emptively to threatened entry or in a particular manner once entry has occurred. In such cases, the incumbent’s intent is to favorably shape the structure of market competition. The (potential) entrant, in turn, faces a decision as to how to best respond to the incumbent’s behavior, and indeed the incumbent’s action likely builds expectations of this reaction into their initial strategy. Spatial models can provide insights into resource allocation and price determination.

Spatial Competition, Strategic Entry Responses, and the North Dakota Railroad War of 1905

Standard Deviation

A measure of how spread-out values are in a dataset, representing the average distance of each point from the mean. In a normal distribution, about 68% of data points lie within one standard deviation of the mean.

Industrial Policies and Innovation: Evidence from the Global Automobile Industry

Static Interventions

A treatment strategy where assignments remain fixed and do not adapt based on individual responses or new information.

Dynamic Targeting: Experimental Evidence from Energy Rebate Programs

Statistically Insignificant

When observed effect or difference in a study is plausibly due to chance rather than a true effect.

What is Newsworthy? Theory and Evidence

Statistically Significant

A result in data analysis or hypothesis testing that is unlikely to have occurred due to random chance, based on a predetermined significance level (e.g., 5%). A statistically significant finding provides evidence to reject the null hypothesis, suggesting that the observed effect is real and not merely a result of random variation in the data.

Disemployment Effects of Unemployment Insurance: A Meta-Analysis

Steady-State Background Death Toll

The number of deaths from COVID-19 that occur outside the event of a new variant wave.

Quantifying the Social Value of a Universal COVID-19 Vaccine

Steady-State Level Of Income

A condition where key economic variables (like output, capital, and consumption) remain constant over time. In this state, an economy experiences no new net growth or decline, as investment equals depreciation, and the economy has reached a stable equilibrium.

Neoclassical Growth in an Interdependent World

Stickiness

The resistance of certain economic variables, like prices or wages, to change quickly in response to inflation.

Structural Mobility

Changes in an individual’s income or occupational status due to broad economic or societal shifts that affect large segments of the population.

The Evolution of Black-White Differences in Occupational Mobility Across Post-Civil War America

Structural Model

An economic model that estimates how agents (e.g., payors and providers) interact, used to simulate policy outcomes and predict the effects of market changes.

Painful Bargaining: Evidence from Anesthesia Rollups

Substitutes

Goods or services that can be used in place of one another to fulfill the same need or want

Measuring Markets for Network Goods

Sunk Costs

An expense or investment that has already been made and cannot be recovered, regardless of future decisions.

Economic Shocks and Healthcare Capital Investments

Supplemental Security Income (Ssi)

A federal program that provides monthly cash payments to people with limited income and resources, including people who are blind, age 65 or older, or have a qualifying disability. SSI is administered by the Social Security Administration.

Homelessness and the Persistence of Deprivation Income Employment and Safety Net Participation

Survey Experiment

A research method that combines survey techniques with experimental design to investigate how changes in the presentation of questions or information might influence people’s attitudes, beliefs, or behaviors.

Central Bank Communication with the Polarized Public

Sustainable investing

Sustainable investing is an investment strategy that considers environmental, social, and governance (ESG) factors in addition to financial returns. The goal is to achieve financial returns while also creating positive environmental and societal impacts.

Switching Barriers

The costs or obstacles a business faces when altering its operational processes, suppliers, or systems.

Gaining Steam: Incumbent Lock-in and Entrant Leapfrogging

T

Third Industrial Revolution

Begun in the late 20th century, this era is characterized by the shift from mechanical and analogue technologies to digital electronics; key drivers include computers, the internet, and telecommunications.

Superstar Firms Through the Generations

Total Factor Productivity (Tfp)

A measure of how efficiently a firm converts inputs (labor, capital, and materials) into output, capturing productivity improvements beyond changes in input usage.

Supply Chain Shocks and Firm Productivity: The Role of Reporting Quality

U

Uncovered Interest Parity

A theory stating that exchange rates should adjust so that the difference in interest rates between two countries is offset by expected changes in their currencies, leaving no opportunity for expected profit from interest rate differences.

Exchange Rates, Natural Rates, and the Price of Risk

Upward Income Mobility

The tendency to earn more than one’s parents.

The Evolution of Black-White Differences in Occupational Mobility Across Post-Civil War America

Us Federal Funds Rate

This is the interest rate at which banks and other depository institutions lend money to each other, usually overnight. It’s the central interest rate in the US financial market and influences other interest rates, such as the prime rate, mortgages, loans, and savings.

Discount Factors and Monetary Policy: Evidence from Dual-Listed Stocks

V

Value Of Statistical Life (Vsl)

This is the common method used to put a monetary value on human life and which is often used in policymaking. Formally: The additional cost that individuals (or society) would be willing to bear for improvements in safety (or reduced risk) and to decrease mortality. For example, if an individual is willing to pay $1,000 to reduce the annual risk of death by one in 10,000, she is said to have a VSL of $10 million.

Lives vs. Livelihoods: The Impact of the Great Recession on Mortality and Welfare

Variant of Concern

A technical designation, reflecting a new COVID variant’s increase in transmissibility, more severe disease (for example, increased hospitalizations or deaths), significant reduction in neutralization by antibodies generated during previous infection or vaccination, reduced effectiveness of treatments or vaccines, or diagnostic detection failures.

Quantifying the Social Value of a Universal COVID-19 Vaccine

W

Wave Interference

The overlapping and interacting effects of economic activity in different regions, which makes it difficult to isolate the role of agglomeration shadows.

Dynamic Targeting: Experimental Evidence from Energy Rebate Programs

Welfare

The monetary evaluation of the economic benefits and costs affecting an individual’s or society’s well-being.

Optimal Urban Transportation Policy: Evidence from Chicago

Welfare Costs

Reductions in social welfare caused by economic distortions, such as inflation.

Why Do Workers Dislike Inflation?

Welfare Effects

Changes in economic welfare caused by changes in economic variables, like economic shocks, income, employment, taxes, and so on.

Lives vs. Livelihoods: The Impact of the Great Recession on Mortality and Welfare

Welfare Gain

The increase in overall well-being or economic benefit resulting from a specific policy or intervention.

Dynamic Targeting: Experimental Evidence from Energy Rebate Programs

Wholesale Funding

This is when banks use Federal Reserve funds, time deposits, or brokered deposits to make loans; such deposits, for example, are made by legal entities, sole proprietorships or partnerships. Because this credit is unsecured, it tends to be more expensive than retail deposits.

Willingness To Pay (WTP)

An economic concept that represents the maximum amount a person is willing to spend for a good or service.

Blinded Versus Unblinded Review: A Field Study Comparing the Equity of Peer-Review

Within-Subjects Design

An experimental design wherein each participant is exposed to all levels of the independent variable (also called treatments or conditions). Essentially, every participant serves as their own control, allowing for direct comparison of their responses across different conditions.