- About

- Initiatives

- Research Initiatives

- Big Data Initiative

- Chicago Experiments Initiative

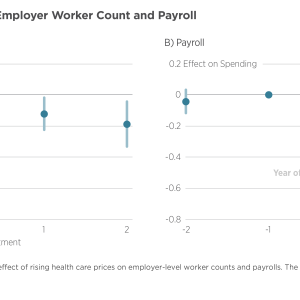

- Health Economics Initiative

- Industrial Organization Initiative

- International Economics and Economic Geography Initiative

- Macroeconomic Research Initiative

- Political Economics Initiative

- Price Theory Initiative

- Ronzetti Initiative for the Study of Labor Markets

- Research Initiatives

- Scholars

- Research

- Seeing like a Citizen: Experimental Evidence on How Empowerment Affects Engagement with the StateSoeren J. Henn, Laura Paler, Wilson Prichard, Cyrus Samii and Raul Sanchez de la SierraSocial Origins of Militias: The Extraordinary Rise of “Outraged Citizens”Gauthier Marchais, Christian Mastaki Mugaruka, Raul Sanchez de la Sierra and David Qihang WuOn the Origins of Direct Rule: Armed Groups and Customary Chiefs in Eastern CongoSoeren J. Henn, Gauthier Marchais, Christian Mastaki Mugaruka and Raul Sanchez de la Sierra

- Events

Upcoming Events

Past Events

- Insights

BFI Videos

BFI Youtube Channel

- News